© Car Adviser 2024 - All rights reserved.

> Home / GAP Insurance / GAP Insurance Providers

GAP insurance is an optional insurance policy that you can add to supplement your comprehensive insurance cover. GAP insurance can help you recoup more money if your car is ever written off, stolen, or lost.

There are plenty of great GAP insurance providers in the UK. Here’s a look at some of the best options in the country, complete with reviews and key points about each one so that it’s easier to compare your options and find the right cover for your situation.

As GAP insurance is an optional and additional expense, you must research your options to ensure that you get the best deal possible.

GAP insurance is a type of insurance policy you can take alongside your standard insurance cover. Cars depreciate over time, meaning they’re not worth as much as they were when you first bought them. GAP insurance is in place to ensure that you get back the total value of your car when you claim it.

On average, a car can be worth 60% less after three years than when you bought it. Because insurance providers payout the value of the car at the time a claim is made on it, it means that you could lose out on money. GAP insurance helps you get back more money by paying the difference between your car’s current value and how much you paid for it when you first bought it.

How GAP insurance pays out can differ depending on the type you choose. For example, ‘back to invoice’ GAP insurance will pay the difference between how much you bought the car for and the value it was when you made an insurance claim. Alternatively, you could also have a type of GAP insurance that pays the difference between the value of a new car model when you made a claim and how much your car was worth. These two options could create different payouts, so choosing the right type of GAP insurance is essential.

GAP insurance is not essential and is not worthwhile for people in many situations. This is because most comprehensive insurance policies will help you replace your car with a new one of the same age and model. GAP insurance is only a good option if you want a brand-new car.

Plus, if you’ve bought a used car, there may be a minimal benefit to getting GAP insurance. This is because used cars depreciate much slower, meaning that the difference between their value when you buy them and their worth after a year or two is very small. When you factor in the cost of getting GAP insurance, it’s almost pointless for most used car owners.

GAP insurance is perhaps most helpful if you’ve used a finance scheme to purchase your car. This is because getting GAP insurance can help you fully repay the car loan, meaning that you won’t be making repayments for a car you cannot drive.

If your situation suits getting GAP insurance, then read on for a detailed look at all the different GAP insurance providers to help you find the best GAP insurance in the country. If you’re still unconvinced about GAP insurance, you can learn more about it on Car Adviser.

The best GAP insurance providers in the UK for 2024 are Direct GAP, MotorEasy, Click4Gap, ALA Insurance and Gapinsurance.co.uk. We reviewed each of them in more detail below to help you make a decision:

| Provider | Rating | URL |

|---|---|---|

| Direct GAP | 4.8/5.0 | directgap.co.uk |

| Motoreasy | 4.7/5.0 | motoreasy.com |

| Click4GAP | 4.4/5.0 | click4gap.co.uk |

| ALA Insurance | 4.9/5.0 | ala.co.uk |

| GAP Insurance | 4.8/5.0 | gapinsurance.co.uk |

If you’re looking for a website that specialises in GAP insurance, then Direct GAP is a great option. This website is FCA regulated, which can be trusted to deliver a good service and offers three of the most common types of GAP insurance.

Direct GAP has a few good features that help it stand out against some of its competitors. Firstly, it covers all your named drivers, which isn’t the case for most. There are also no mileage restrictions during the life of your policy, meaning that you can always claim no matter how far you drive. Plus, you can claim as much as you need for vehicles under £50K in value.

A review score of 4.8 on Trustpilot makes Direct GAP an excellent business, just like all the other companies reviewed on Car Adviser. A score of 4.8 is also one of the highest any provider has on the website.

However, they have a small sample size on Trustpilot, with only 309 reviews. This means that their score can be easily manipulated, and it’s not as reliable as a business with over 1000 reviews, for example.

That said, they have multiple reviews on Feefo and obtained a 4.9-star rating there.

On Trustpilot, some of the more common complaints that Direct GAP get is that they will delay claims, despite their promise to settle them within 10 days.

One reviewer also said that the company allowed them to take out GAP insurance despite the car not being eligible for cover, with them feeling like they were missold a product.

Their customer service has also been referenced as poor, with more than one reviewer stating that they were hung up on, and many others felt that the operatives lacked experience and knowledge of the process.

On Trustpilot, Direct GAP is praised by its past customers for guiding many of their customers through the process of buying GAP Insurance, including explaining how it works and how they operate.

Many also highlight how helpful some of the brand’s features are, such as how you can claim multiple times and how you can switch your policy type easily.

Pros

Cons

MotorEasy can be considered your one-stop shop for all your vehicle admin services. With MotorEasy, you can easily get services to help with car maintenance.

In addition to getting GAP insurance from MotorEasy, you can also get many other things like an MOT, breakdown cover, warranty, tyres, and cosmetic insurance. MotorEasy makes things simple for you by allowing you to create an account for your vehicle and add and book whatever service or feature you need.

In terms of their GAP insurance, you’ll be able to save up to 75% on dealer prices. They cover most new cars, providing that they are no older than ten years old or have driven 100,000 miles.

With MotorEasy, you’re covered for write-offs due to:

With a 4.7 score on Trustpilot, one of the leading review websites online, MotorEasy has a claim for being one of the most liked and reputable GAP insurance companies in the UK.

The rating means that MotorEasy can be considered an excellent business and provides a service that is unlikely to disappoint you. Comparing it to other GAP insurance providers reviewed on Car Adviser shows it’s actually one of the lowest scores despite having a good rating.

However, what makes MotorEasy more trustworthy is that they typically have many more reviews than some other brands. With 8,270 reviews, they have a large enough spread of data to suggest that their score is accurate. In comparison, some brands only have around 300 reviews on Trustpilot, making their overall scores a bit more dubious.

Of their reviews, 83% gave MotorEasy a 5-star review, while only 4% gave a 1-star one.

Although they don’t have many negative reviews, there are still a few complaints and issues that past customers have experienced.

Many issues discuss a lack of communication, particularly when making a claim. Some have said that they haven’t been informed that their claims have been denied, which can be a problem if you’re trying to get GAP insurance payouts.

Another complaint brings up issues about the customer service team, which are hard to contact and not helpful for many people.

It’s worth mentioning that many of these common claims have been replied to by a MotorEasy rep. Many of these replies provide a better context for each complaint, and for some, you can see the reviewer is in the wrong. This means that you really shouldn’t be put off by some of the common complaints.

MotorEasy has far more positive feedback than negative feedback, so it’s worth looking at this to see what the brand does well.

Many people praise the quality of the service and how helpful the brand has been when making a claim or when getting GAP insurance. Many also highlight that getting GAP insurance online was very easy and that the quoted price was lower than many dealerships.

Pros

Cons

Click4Gap allows you to get GAP insurance online and is very quick and easy to use. With this service, you get GAP insurance from the instant you purchase the cover and can get it for personal and business travel.

With Click4Gap, you get much more comprehensive cover and will get a payout if either your car or keys are stolen, and all your named drivers can get protection too.

Click4Gap offers cover for various car owners and finance methods, meaning that if you leased your car, bought it outright, or even have a hire purchase agreement, you can get GAP insurance.

The Click4Group, the parent company of Click4GAP, has a Trustpilot score of 4.4 after 1,476 reviews. This rating means that the business is considered a valued and trustworthy business by the review website. However, compared to other options reviewed on Car Adviser, it’s actually one of the worst.

That doesn’t mean that Click4GAP is bad; it just suggests that you may be able to find a slightly better service elsewhere that can perhaps give you more for your money.

Of their reviews, 72% gave them the full 5-stars, the lowest ratio of the brands explored here. They also have 8% of their reviews as 1-star, the highest among the best GAP insurance providers.

One big complaint that a few past customers of Click4GAP bring up is that their GAP insurance type is return to purchase value, which typically doesn’t pay as much as return to invoice. This means that many people have lost out on a large chunk of money because of this.

Their GAP type is mentioned in their terms and conditions, but it’s easy to miss and can be an issue.

Another complaint is that their customer service can be a bit flawed, with many people waiting on hold for a long time only to be passed around between departments and staff.

A lot of positive reviews on Trustpilot say that purchasing GAP insurance was easy to do online. They also praise the various options you have, allowing you to get insurance no matter how you bought your vehicle.

In fact, the majority of the positive feedback is about how stress-free the experience of joining and getting GAP insurance was, which demonstrates that Click4GAP is easy to use and simple. If you value an efficient process, this could be the option for you.

Pros

Cons

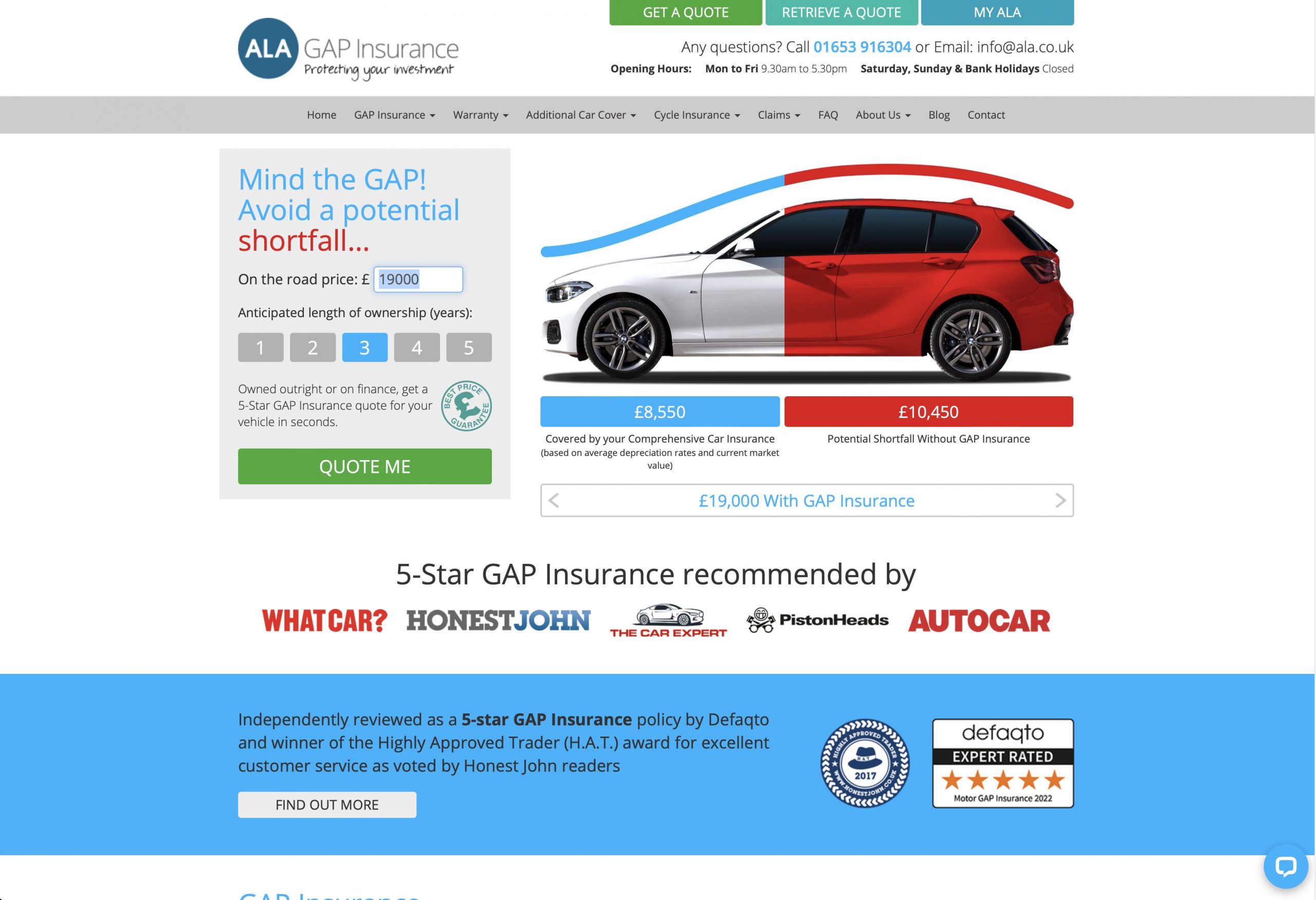

ALA Insurance is one of the leading insurance providers in the UK, especially for GAP. You can get insurance online with ALA and quotes for other types of cover, including cycle insurance and a RAC Warranty.

The business is endorsed by multiple car review websites, meaning that various thought leaders trust them in the industry. You can get numerous types of GAP insurance with ALA, making them a great option.

ALA insurance has the best review score out of all the GAP insurance providers reviewed on Car Adviser, with a near-perfect score of 4.9 out of 5. This suggests that ALA is a fantastic place to get GAP insurance and that many have been left impressed.

The percentage of good reviews ALA have gotten rather implies this, as 92% of their reviews on Trustpilot are 5-star, one of the industry’s highest percentages. The rest of their reviews are mainly 4-star, as under 1% of reviews gave the business a single star.

Usually, such an overwhelmingly positive review score would have people a little wary. However, because ALA Insurance has over 13,000 reviews, their score can be trusted more due to such a large sample size.

There are not a lot of bad reviews to use to find some common complaints and issues against ALA Insurance, especially regarding their GAP insurance. Out of the 100 or so negative reviews on Trustpilot, most of them are referring to their warranty service, citing that it has been tough to get a payout on occasion. This may indicate that successfully claiming GAP insurance could also be tricky, but that is a stretch as there’s no indication of this being the case.

Of course, it’s important to say that these seem to be isolated instances. However, it does look like they follow a robust process to ensure you’re eligible for a claim.

Many things are highlighted as being good with ALA Insurence, including how good the service and customer services are.

However, one of the most common praise is that ALA Insurance has offered many past customers the best prices among those that they compared. This means that ALA Insurance is an excellent value for what you’re getting.

Pros

Cons

Gapinsurance.co.uk has been providing GAP insurance in the UK since 2004, making them a vastly experienced brand in the industry.

You can get GAP insurance for both new and used cars with the company, and they’re rating a quality insurer. With this, you get paid out in cash, and there’s no market value clause, meaning that you get back the same amount you paid for your car.

Despite having a great score of 4.8 on Trustpilot, which makes it an excellent business and one of the highest rated, it’s essential to be aware that the brand only has 83 reviews. This means that there’s a lot of weight put on each individual review and that its overall score isn’t as reliable as a business with much more. That said, they have a good rating on Feefo after many more reviews.

It might be worth exploring this brand with more caution as they may not be as good as the rating suggest.

No reviews on Trustpilot have given Gapinsurance.co.uk a bad score, meaning that there are not many complaints to look at. This lack of bad reviews is enough to question the brand, as it’s unrealistic to expect a business to avoid complaints.

When looking at the 3-star reviews, despite being positive, some had said that the cover has been reduced and that it isn’t as good as it once was. This may suggest that you can’t get as comprehensive cover with Gapinsurance.co.uk.

Out of the positive reviews that the brand has gotten, many have said that the customer service was very helpful with the process, giving advice and information to make getting GAP insurance a better process.

More reviews praise the customer service team for being responsive and helpful, meaning that if you’re looking for a good quality of care after getting your policy, this could be a good option for you.

Pros

Cons

The number of times you can claim on GAP insurance will depend on the insurance provider, as each will have its own criteria and rules. That said, the average amount of times you can make a claim is four times in any twelve months within a policy term.

Hopefully, most people won't need to make more than one claim for a vehicle, meaning that most will not reach this maximum limit.

Of course, the number of times you can claim on your policy may affect its price, so depending on the provider, you may be able to lower your monthly fees by only allowing yourself one to two claims in a calendar year.

You will still get coverage from GAP insurance if you're found to be at fault for why your car has been written off, such as causing an accident or attempting a repair that went wrong.

This can help provide better peace of mind as you'll be able to reliably know that you'll be able to get some cash to help you pay for a replacement vehicle.

You don't have to get GAP insurance when you first get your new vehicle. If you're buying from a dealership, you're not allowed to be sold GAP insurance on the same day you purchased your car. Instead, you'll usually be offered GAP insurance two days after your vehicle purchase.

With that said, there is a time limit for when you're able to buy GAP insurance. Most providers will give you 90 days to get GAP insurance when you buy your car. If you wait longer than that, you may not be able to get GAP insurance for that vehicle at all.

Many people get caught out by this, as many people plan to wait until their car is over a year old, as most insurance providers will just give you a new car if it was written off in the first 12 months. However, as you can't get GAP insurance this long after buying a car, they cannot get this insurance.

| Cookie name | Active |

|---|