© Car Adviser 2024 - All rights reserved.

> Home / Buying A Car / Bad credit car finance

Find the best bad credit car finance providers in the UK.

Car finance is a very popular way for people to pay for cars. Most people will struggle to pay for a vehicle outright with their own money, which is why people get personal loans and other forms of car finance plans to make buying a car a little easier.

However, because car finance is considered a credit product, you will need a good credit score to be accepted for the best deals. When you take out a loan or get car finance, you’re borrowing, and the providers need to know if you can be trusted to pay everything back. If you have a bad credit score, then you can’t be trusted and will not get favourable terms or could get rejected.

Thankfully, there are plenty of bad credit car finance providers online and on the high street that you can use to circumnavigate this issue. Some may charge more, and others may have different flaws, but there are still many fantastic options for you to get bad credit car finance from. You can learn more about the best poor credit car finance lenders here and discover more about buying new and used cars on the rest of the Car Adviser website.

Bad credit car finance is a type of finance option that’s tailored to those who have poor credit scores. When getting traditional car finance, some providers will require you to have a good credit score to be accepted. This is because if you have a poor score, you’re more likely to miss a repayment or mismanagement your loan in another way, making you a riskier person to lend to.

To help those with bad credit, specialist providers exist who offer car finance to those struggling to get accepted elsewhere. These providers are more likely to provide you with a car finance plan; however, the terms may not be as good as the plans offered to those with good credit.

For example, if you apply for car finance and have a good credit score, you can expect a finance package with a low percentage rate, typically under 10%. However, car loan providers for bad credit will usually offer you a deal with much higher interest, which could average at around 30% and even be even higher than this.

A higher interest rate means that the amount you have to pay back for your financial plan increases by that percentage over time. This means that you can end up paying a lot more in total for the car than you would have done if you had a better credit score.

There are definitely positives and negatives to getting bad credit car finance, so it’s something that you’re really going to have to consider a lot to make sure that it’s the right option for you.

For example, although poor credit car finance lenders can allow you to get a finance deal for your car, it will be a more expensive option than just buying the car outright. That said, when you manage your repayments well, it has the potential to boost your credit score so that you can get access to better car finance deals in the future. However, if not budgeted correctly, committing to pay significant sums of money each month for at least a few years can harm your future finances if your circumstances change. We at Car Adviser believe that using poor credit car finance lenders is a risk, although it can be helpful if appropriately managed.

We admit that bad credit car finance can be a tricky thing to understand and get your head around, especially if you’ve never bought a car through finance. Thankfully, we’ve put together the ultimate guide to bad credit car finance so that you can better understand what it’s like and what to expect if you choose this finance option. You can find our guide on here.

It’s hard to say precisely how much a bad credit car finance plan will cost you because it will be different depending on how much you borrow, the value of the car, and what percentage rate you’re offered. How much you have to pay also depends on what specific car finance option you choose to use and how big of a deposit you put down at the start of your term.

For example, a hire purchase agreement will usually be more expensive and last longer because you’re working to pay off the car so you can own it. In contrast, a personal contract purchase is where you’re paying for the car’s depreciation and aren’t going to end up owning the vehicle at the end of the agreement unless you make what’s called a balloon payment. This option usually has cheaper monthly repayment rates.

Despite not being able to fully know how much a car finance plan will cost, it’s clear that you will be paying a fair bit more for the car throughout your financial plan if you have bad credit compared to if you had a good credit score. This is because of the increased interest rate that you’ll have to pay.

Here’s an illustrative example to demonstrate the possible extra amount you will have to pay when getting bad credit car finance.

If you have a low credit score, you’ll likely get offered a bad credit car loan at a representative APR of 23.9%. APR represents the extra amount of money you need to pay back for your loan after a calendar year.

With this finance plan, you agree to pay for a car worth £8,500 over 36 months. This means that you’re making 36 separate payments for the vehicle. You also decide to put down a deposit of £500 to reduce how much you’re borrowing to £8000.

To figure out how much you have to pay back every month to cover the loan and interest cost, the lender will use a fairly complicated equation to see how the 23.9% APR affects the total amount owned. For these terms, you will have to pay £304 a month.

Over 36 months, these repayments add up to £10,944. When you subtract the original amount of £8,000 borrowed for this car finance plan, it shows that interest has added an extra £2,950 to what you owe, which is a significant chunk of money.

Of course, if you decide to pay back the loan over a shorter period, such as in 24 months, then interest will have less time to take effect, resulting in a shorter total amount you have to pay. That said, decreasing the time needed to repay a car finance plan will increase how much you have to pay each month, so you need to jungle affordability with the total cost to work out the best car finance plan for you.

There are plenty of great poor credit car finance lenders online where you can get loans and useful information from these products. For this article, Car Adviser has put together some of the best places to find good bad credit car finance and bad credit loans.

Among some options are dedicated businesses that will offer you car finance plans, as well as popular comparison sites that will allow you to check your eligibility and use their resources to find the best car finance option for you that you’re likely going to be accepted for. Some of these businesses will also be brokers, meaning they won’t offer you finance deals directly but will show you providers who may accept you.

You can’t go wrong with any of the businesses and resources suggested in this guide. However, we’re also providing each business’s Trustpilot ranking so that you can determine which provider is best for you.

Note that all the bad credit car finance lenders on this list are FCA regulated.

| Provider | Customer Rating | Website |

|---|---|---|

| ChooseMyCar | 4.9/5.0 | choosemycar.com |

| Moneybarn | 4.6/5.0 | moneybarn.com |

| Money Super Market | 3.4/5.0 | moneysupermarket.com |

| Confused | 4.4/5.0 | confused.com |

| CarFinance247 | 4.7/5.0 | carfinance247.co.uk |

| Stoneacre Motor Group | 4.0/5.0 | stoneacre.co.uk |

| Zuto | 4.6/5.0 | zuto.com |

| GoCarCredit | 4.3/5.0 | gocarcredit.co.uk |

| Refused Car Finance | 4.9/5.0 | refusedcarfinance.com |

| CarVine | 4.9/5.0 | carvine.co.uk |

| The Car Loan Centre | 4.3/5.0 | thecarloancentre.co.uk |

Do note that the bad credit car finance provider that suits you may be different from the one that’s best for someone else. This is because you’ll have various requirements and needs and be in different financial situations, which can affect the value of each provider.

Here are the UK’s top car finance and car loan providers for bad credit.

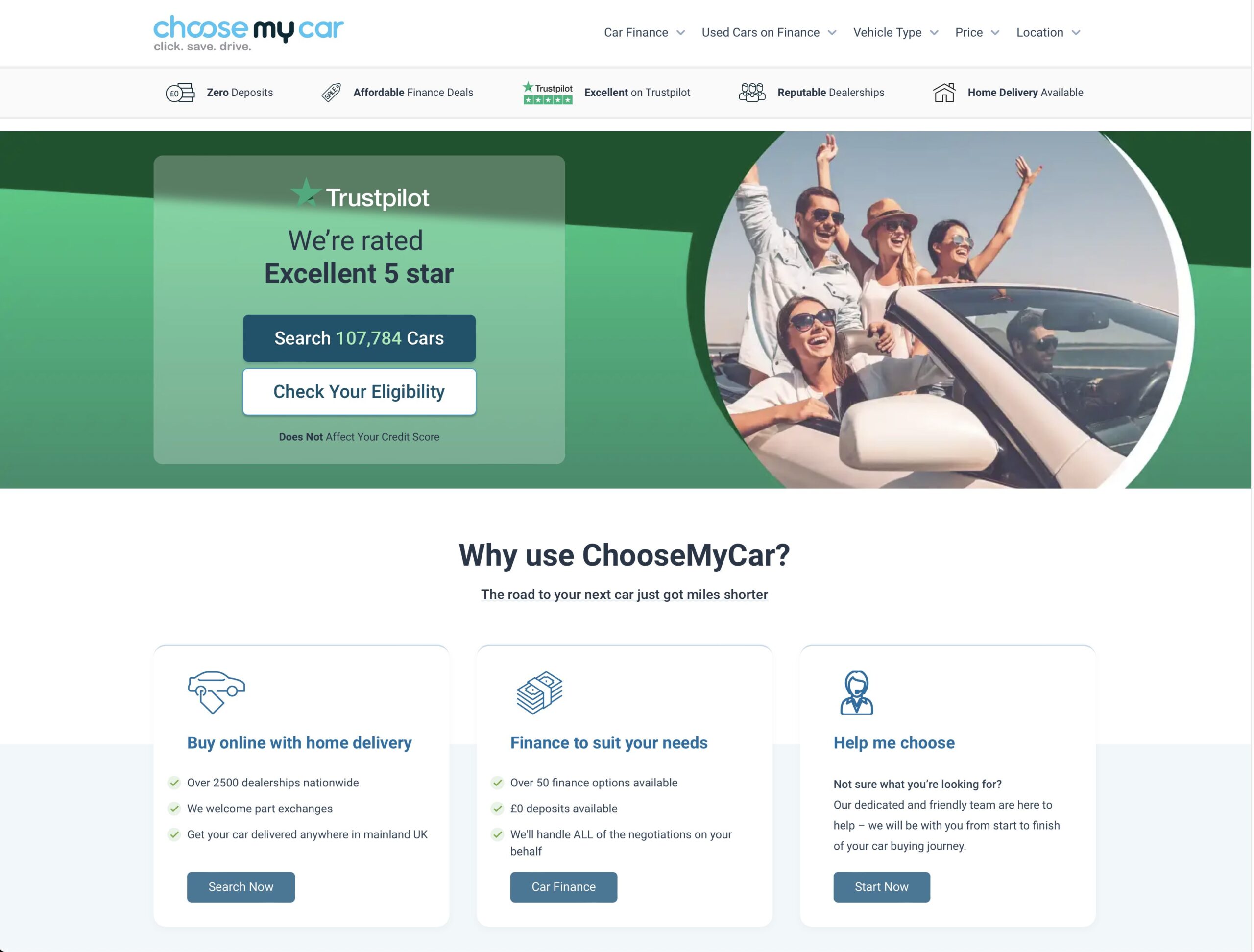

ChooseMyCar is a used car finance specialist, meaning they have a lot of great experience when it comes to offering car finance to those with bad finance.

When you opt to get a finance plan from ChooseMyCar, you’ll be able to use their intuitive loan calculator tool to figure out how much your loan repayments will be depending on how much you take out and how long you want the term of the loan to be.

This gives the website an outstanding level of transparency, as users will know exactly what they’re getting into. In fact, the provider is extremely clear with its terms and promotes what their representative APR is front and centre of the webpage.

That APR is a representative 21.4%. Depending on the specifics of your credit score, you could have to pay more or less than that; however, if you do have bad or poor credit, the best available rate will be around 25.4%.

When you get a quote from ChooseMyCar, they’ll use a soft search to see your affordability. This does not affect your credit rating, and there’s no obligation to use ChooseMyCar. This means that this is a great place where you can see the options available to you that you are likely to be accepted for.

ChooseMyCar has an excellent reputation and has obtained a near-perfect score of 4.9 stars out of 5 on Trustpilot. This means that the vast majority of the users have benefited from their experience with ChooseMyCar. The high volume of positive reviews illustrates this.

Many people have praised the customer service team and appreciated how invested they seemed to be when trying to broker a finance deal. In fact, the vast majority of the reviews seem to focus on how good the personal aspect was between the customer and their customer service operative.

That said, when you look at the low amount of negative reviews, a common complaint is that some people have still been rejected for car finance despite being initially approved. It’s essential to make clear that ChooseMyCar is just a broker who gets you in touch with dealers and providers offering finance plans. You may initially pass their testing and screening; however, the lender may still reject you when you do apply. This can be frustrating, but it is a rare occurrence, and most of the time, you can be confident that you’ll be able to get a bad credit car loan when passing their initial checks.

Pros

Cons

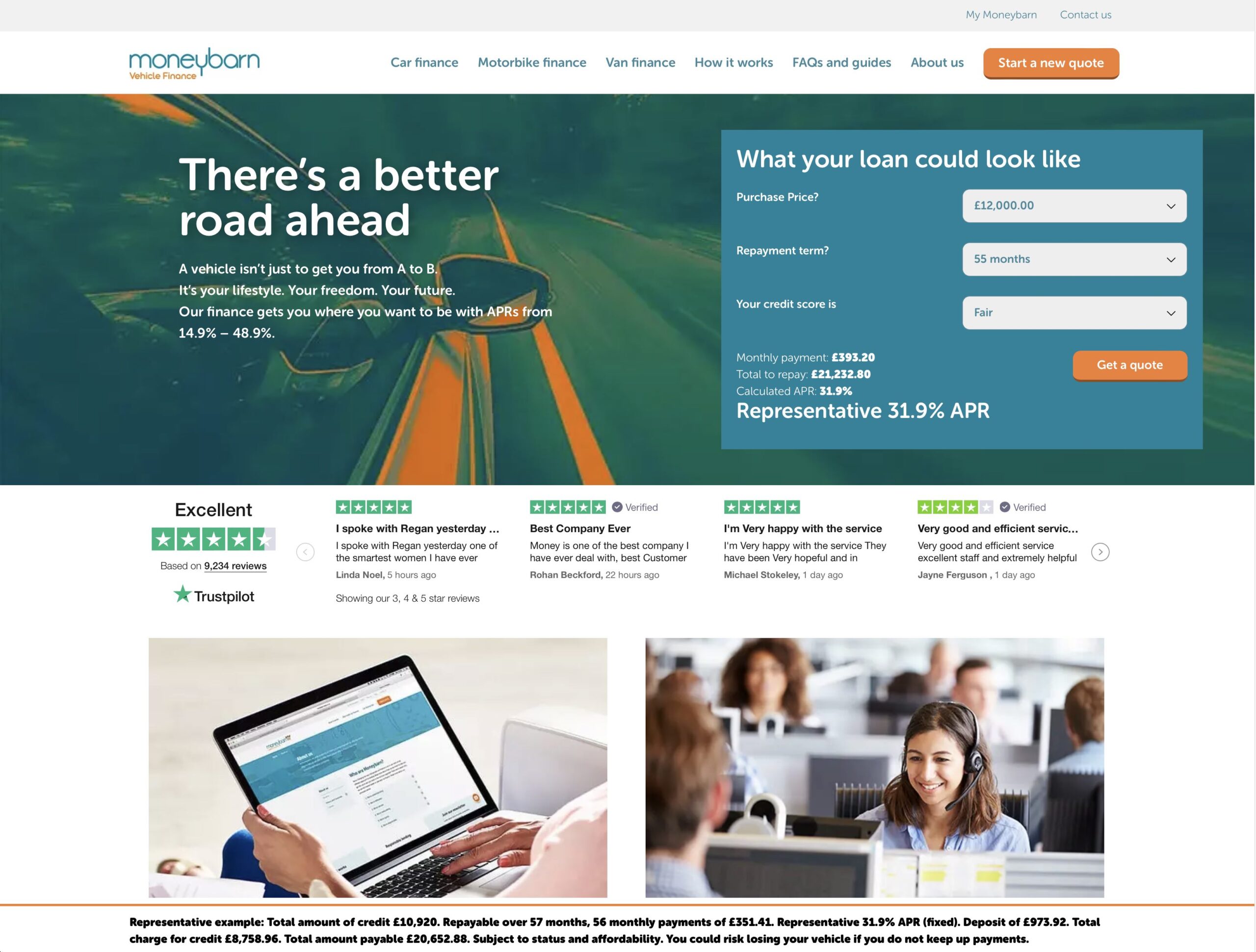

Moneybarn is a car finance company offering various car finance products for those with both good and bad credit scores. As a result of this, their representative APR can fluctuate a lot, with it ranging from 14.9% all the way to 48.9%.

The website has a loan calculator function where you can input the car’s purchase price, your desired repayment term, and your credit score. With this data, you’ll be able to see how much your monthly repayments are, what the APR you’ll be offered is, and how much you have to repay in total.

When using the loan calculator from Moneybarn to get a quote for a poor credit score, the APR increases to a 48.9% interest rate, which is a very high amount. This APR could have you paying back more than double the value of the car you’re borrowing for, although this does depend if your repayment term is long enough. In addition, you cannot check to see what the APR is if you have a bad credit score.

Most bad credit car finance providers will rank credit with the levels of Excellent, Good, Fair, Poor, and Bad. With Moneybarn not giving you the option to check quotes for bad credit, it may mean that they have more strict eligibility criteria than most bad credit car finance providers.

When applying for car finance with Moneybarn, you need to make sure that you have a consistent monthly income of £1,000; otherwise, you will not be accepted. This income can come from work, pension, or even benefits.

On Trustpilot, Moneybarn has a respectable rating of 4.6/5, making it an excellent business and one that you can trust. The vast majority of those leaving feedback have rated the company 5-star, with many praising Moneybarn’s approach to eligibility.

Many car finance providers will focus only on an individual’s credit score, whereas Moneybarn emphasises on how much you earn to see if you can afford a loan. This helps those who may have bad credit but a solid income get a car on finance, which many people have praised.

When looking for any obvious flaws with the business, a couple of common complaints pop up when looking at the bad reviews. Many have stated that although the process of getting a car on finance has been good with Moneybarn, if that car is faulty or has any issues, there’s been accounts that the complaints team halted correspondence. In fact, customer care has been criticised by a few people, with many saying that they are hard to get a hold of and may not get back to any requests or queries for days on end.

Pros

Cons

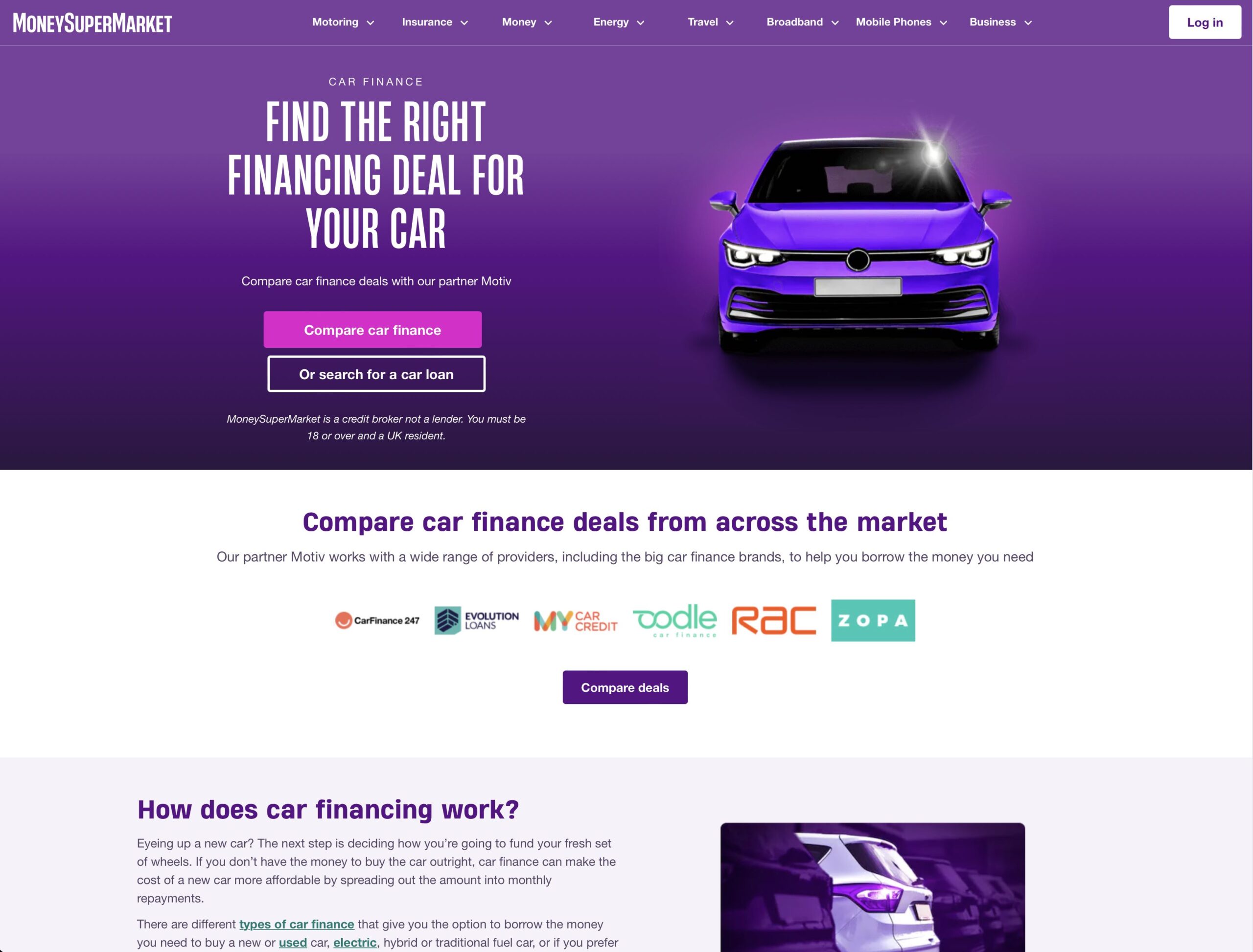

MoneySuperMarket is one of the UK’s leading financial advice and guidance resources on the UK, and it also operates an excellent comparison service that lets you find various credit products for you.

In terms of car finance for bad credit, MoneySuperMarket partners with a brand called Motiv, which works with a range of finance providers to help you borrow the money you need for your car.

What’s great about MoneySuperMarket is that it’s a very informative resource and gives users a lot of information so that they can understand their options regarding car finance before they commit to anything.

There is no easy-to-use loan cost calculator on the website, making it hard to see what terms you’ll be offered without inputting your personal details. That said, if you click on their ‘compare deals’ call-to-action, you’ll be able to fill out a detailed form to see what you can get. You’ll have to provide a lot of personal information in this form. It does mean that your quotes will be accurate, but it’s not good if you want a quick idea of what to pay.

That said, MoneySuperMarket advertises its Motiv service as having a 23.9% representative APR, which is one of the lowest so far.

On Trustpilot, MoneySuperMarket has an average score of 3.4 out of 5, which is a pretty surprising rating for a company with its authority level. When looking to see why this brand has such a low score, you’ll find many complaints about how many of its recommendations may not be the best option in the market.

Businesses like MoneySuperMarket work through commission, meaning that if someone buys a credit product after being suggested that product by MoneySuperMarket, they’ll get a cut of that transaction. This can lead to comparison websites like this having favourites and becoming less impartial than they should be.

As a result of this, it’s wise to shop around with other comparison sites to see what truly is the best finance deal. With that said, MoneySuperMarket is still a great tool to see the various car finance brands that will accept you if you have bad credit, and it has the functionality needed for you to compare brands properly.

There are still plenty of positive reviews for MoneySuperMarket, with past customers praising the website’s clarity and how they clearly explain each product so that you know what you’re getting into. In fact, many people enjoy how the business provides sound advice to help you find a deal that is worth it for you.

Pros

Cons

Like MoneySuperMarket, Confused.com is a leading price comparison website that can help individuals with various credit and financial products such as loans, insurance, and of course, car finance.

Much like other comparison websites reviewed on Car Adviser, they provide a lot of great detail and insight about what bad credit car finance is and how to get the right deal for you. This makes them a useful resource for those looking for the best deals.

The website also lets you compare bad credit car loan providers and has a tool that allows you to find accurate information about what you’re eligible for. Interestingly, this tool isn’t just for car loans but can also help you find loans for other purposes, such as loans for a wedding or debt consolidation.

However, like MoneySuperMarket, this tool is very in-depth and requires you to input a lot of information about yourself, including your occupation, marital status, and contact information. This may put people off who like to keep their privacy, and it’s also not suitable for those who want to find quick, general quotes so they can better work out how much they’ll have to pay for car finance.

What’s good about Confused.com is that when you do search for loans that will accept you, they’ll show you how likely you are to be accepted by each provider. This can then let you know which loans you can confidently apply for, making the process less risky. The search tool also doesn’t affect your credit score, and it has the added benefit of giving you the exact APR so that you can budget better.

The comparison website scored well on Trustpilot, with a 4.4 out of 5 rating, illustrating that it’s a good business. This means that most people who use the comparison site are happy with the service and have found a good deal. People commonly praise the wealth of information that Confused.com has on various topics, car finance included. The simplicity of their tool has also been praised, making it easy to choose the most appropriate option for you.

When looking at the negative reviews that the site has, you’ll find common complaints about rewards and vouchers not being delivered for a long time. If you’re getting a car finance plan through Confused.com to get a voucher, this can be annoying, but in the grand scheme, it’s not a massive problem, and the business can be considered a place to find the best bad credit car finance providers in the UK.

Pros

Cons

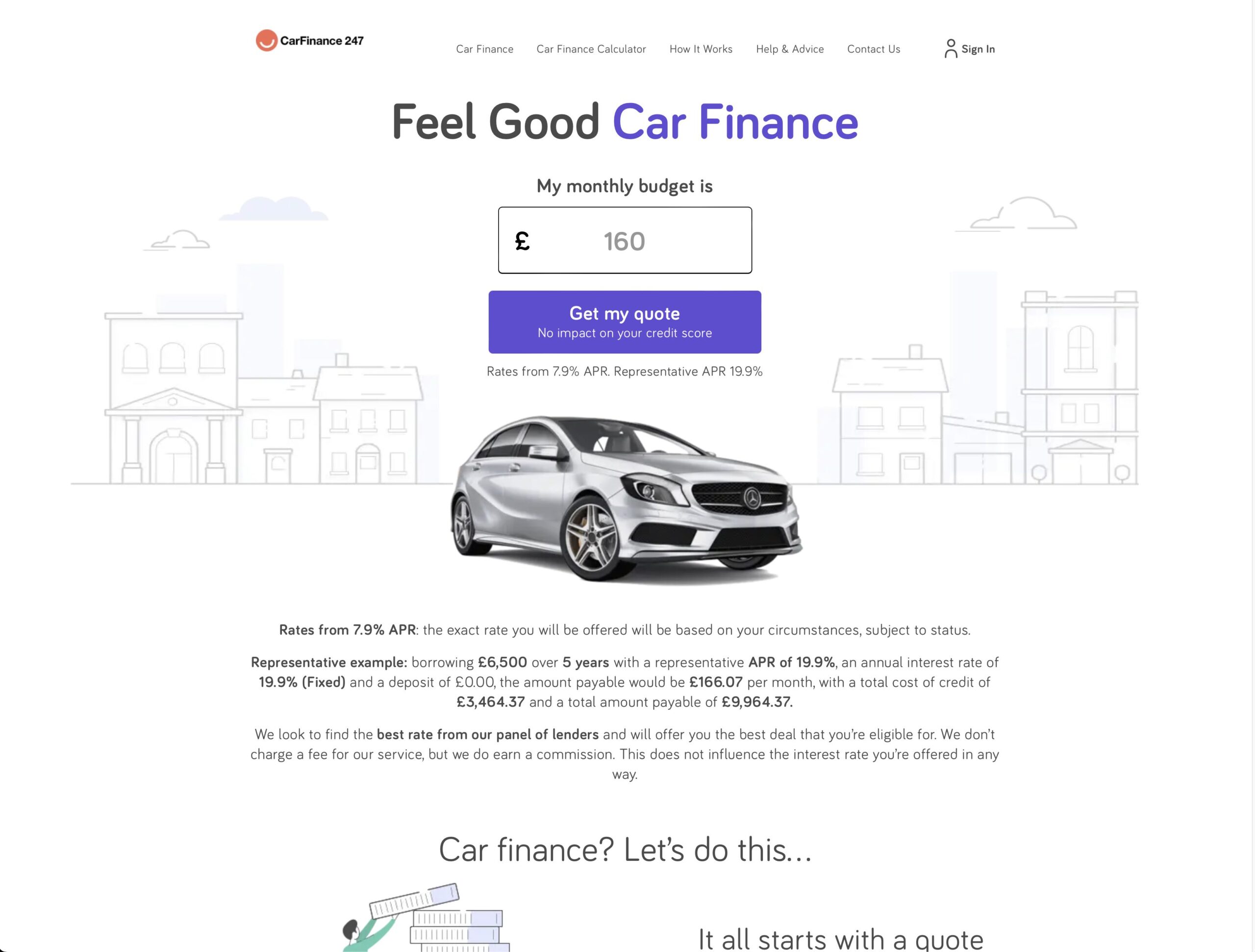

As the name of the business suggests, CarFinance247 is a business dedicated to offering finance plans for those looking to buy both new and second-hand cars. You can get many finance plans with the provider, and they also have options for those with poor and bad credit scores.

With CarFinance247, you can apply for a car loan without affecting your credit score, and you’ll also be able to get a decision within minutes to see if you’ll be accepted.

What’s clever about CarFinance247 is that they have a loan calculator that allows you to input your ideal monthly budget. This gives you far more control over the loan, as you’ll be able to generate quotes for a budget that matches your needs.

The interest rates offered by CarFinance247 look to be pretty good too, as they can start from 19.9% APR and have an average APR of 27.4% APR.

They also provide a good mixture of information and practicality, pairing their useful quote tool with information to help you know your options.

When using their loan calculator tool, you have to enter a similar amount of information as the previous providers to see your quotes, which can be a bit time-consuming and awkward. You’ll have to provide details about where you live, work, and financial information to get a quote. This ensures that loans you can get accepted for are accurate, but it isn’t great if you’re just looking around.

In terms of its reputation, CarFinance247 is one of the most well-respected poor credit car finance lenders in the UK, and have a Trustpilot score that demonstrates that. With a rating of 4.7 out of 5, it ranks as an excellent business that has been able to help thousands of people in the past.

It has a high percentage of 5-star reviews, and when looking through the positive feedback, it’s clear that many people have praised the customer experience and service you can get from the brand. The process has also been said to be pretty speedy, which many people appreciated and valued.

Regarding complaints, CarFinance247 has a few that can harm its trustworthiness a little bit. Many complaints mention that the car they got finance for had issues when it arrived and that these issues weren’t sorted promptly. This is something to consider, as it can be frustrating to have to repay for a car you cannot drive. Also, others have complained that sometimes their eligibility rating isn’t accurate, as some people have been turned down for car finance despite being quoted a 100% approval rate.

Pros

Cons

Stoneacre Motor Group is a business that offers many different auto-related products. Not only can you get finance from them, but you can also buy new and used cars directly from the business and also get things like servicing, repairs, and more.

With Stoneacre Motor Group, you can apply for finance directly on the website by completing a soft search check. This doesn’t affect your credit score, and once you complete it, it will inform you of what type of finance plans you can get. Even if you have bad credit, this tool can inform you of your options.

Stoneacre Motor Group is a bit unique because they are both a lender and a broker. This means you can get finance directly from them or use them to help you find other bad credit car loan providers.

When looking for a bad credit car loan from Stoneacre, they include a well-illustrated table to let you know how much credit will cost when you apply with bad credit. They also have an easy-to-use tool that estimates how much a loan will cost depending on your credit rating. This only lets you check if you have a good, fair, or poor rating, so it can be tough to see what’s available to you if you have bad credit without using their more in-depth eligibility checker.

If you have poor credit, you’ll be quoted an APR of 34.90% if you’re getting car finance from Stoneacre; however, you could find providers who offer better terms when using their eligibility checker.

Stoneacre Motor Group have a solid rating of 4/5, making them a great business from which to get car finance. However, because they offer a large range of auto products, many of those reviews are for products unrelated to car finance and thus may not be an accurate reflection of their car finance service.

When looking at their well-rated reviews, there’s common praise for their variety of tools and resources. People find their eligibility checker and loan cost calculator to be helpful when looking for a loan.

However, when looking at the complaints that the business has got, many people point out that Stoneacre Motor Company has a few hidden fees that may not be obvious when first getting finance from them.

Pros

Cons

Zuto is a car finance provider that can be an excellent option for those seeking a finance plan with bad credit. Zuto is the preferred car finance partner of AutoTrader, the leading car-selling website online, meaning that it’s a well-respected and trusted tool and provider.

Zuto offers two essential tools to those looking for bad credit car finance plans. They first have a great tool that will let you know how much you can borrow based on your preferred monthly repayment amounts and how long you want to repay it over. This means you can better control your loan and ensure you’re getting a deal that suits your finances.

Once you use this tool, you can use their eligibility checker to find car loan providers who will accept you for that loan amount. Zuto considers all credit circumstances, and once you’ve used the tool to find loans that suit you, they’ll also let you know which ones are 100% likely to approve you.

With Zuto, you can get answers fast, get expert advice, and use their tools for free. Zuto is a broker and not a lender, meaning that you don’t get finance from them directly and instead choose out of their various partners.

Zuto has a good reputation within the car finance industry and has obtained an excellent score of 4.6/5 on Trustpilot. With over 12,000 reviews, this score can be trusted and illustrates that most people have had a good, positive experience with the brand.

When looking at their 5-star reviews, you’ll see that plenty of people have praised how Zuto will give you a car-buying assistant to aid in your search for the best car finance deal you can get. These assistants are said to be very helpful and are an excellent additional resource when you need information about bad credit car finance plans.

It’s not all positive for Zuto, however, as they do have a small number of bad reviews that complain about the customer service team hounding you and you can expect to get a lot of emails from them after using their eligibility checker. For some, the emails can become almost spam-like and can get rather annoying.

That said, Zuto has a lot of great functionality that makes it one of the best poor credit car finance lenders you can use.

Pros

Cons

GoCarCredit is a helpful online car finance broker who can help you find lenders that will accept you, even if you have bad credit. In fact, GoCarCredit is one of the few car finance providers that focus solely on those with bad credit, meaning that they’re an excellent option to go to if you’ve been rejected in the past.

The website has a helpful loan repayment calculator so that you can work out how much you’ll have to pay each month for APRs of 29%, 39%, and 49% if your borrowing is low enough. The tool doesn’t clearly show how much you’re paying for credit, nor does it let you adjust it based on your credit score, but it’s a valuable starting point to figure out how much car finance will cost.

GoCarCredit is regulated by the FCA, meaning that your money is protected when you use them, and it also means that they have to meet high standards.

You can get car loans of up to £15,000 with this car loan for bad credit provider; however, you need to have an income of over £1250 to qualify for their lending criteria.

They have a Trustpilot rating of 4.3 out of 5, which is enough to be considered an excellent business, but there is also room for improvement. For example, they have a pretty big percentage of 1-star reviews when compared to some of the other brokers, which many people complaining about long wait times when trying to get in contact with customer service. People have also complained that many of the finance deals offered to you will have you paying over double what the car was worth, which is annoying but is something that can happen if you have bad credit.

When looking at their positive reviews, many people have been happy with the simplicity of the service and how their application process is quick and presents you with offers. Many people using GoCarCredit may not have been accepted for car finance before, so being able to find plans through the business is a massive benefit.

Pros

Cons

Refused Car Finance is an excellent website if you’ve been struggling to get car finance because of bad credit. This is because they can find you a lender who will accept you, even if you’ve been rejected multiple times in the past.

It’s quick to get a quote from Refused Car Finance; however, to get started, the first thing they ask for is your contract details. This can be offputting as it means that you have to commit early to the business before being able to find finance deals that work for you.

That said, they are convenient because they offer you many finance options, as they can even provide solutions for balloon repayments, thus giving you more options.

They operate as both a lender and broker, meaning you can get finance from them directly or through some of their partner lenders.

What can be a bit telling with RefusedCarFinance is that they only have three reviews on Trustpilot, which isn’t enough data to get a clear, accurate rating. That said, they have a decent score on review.co.uk, getting a 4.9 out of 5 on that alternative platform.

When looking at the good reviews, many people praise the service and various team members who have been able to help users get a good deal at a good APR. This is good to see as it suggests that you’ll be able to find a good car finance plan, even if you have bad credit. The customer service is also said to be really good.

In terms of negatives, because you need to enter your email address to get a quote, the company use this to contact you a lot. Many past users have said that the business harasses them with unwanted texts and emails, which can be annoying and can put you off from getting finance with this company.

There are a lot of indications that this could be a very good bad credit car finance provider; however, there do appear to be better, more trusted options out there.

Pros

Cons

CarVine is a company that makes getting car finance simple and easy. They offer finance plans for those with low and poor credit scores and can help even if you’re self-employed, defaulted on a loan in the past, or have a CCJ against you.

On their page, they have a helpful tool that lets you see how much you’ll have to pay a month to pay off a loan, and you can adjust the parameters based on the amount you borrow, the time that you take to pay it back, and the credit score that you have.

CarVine has a representative APR of 24.9%, which is very average for those looking for car loans for bad credit. Once you’ve used the loan calculator tool, you can then run a soft search with them to see what finance options and lenders you’ll be accepted for. With CarVine, you can get finance for not only your car but also for a van, motorbike, caravan, truck, and electric taxi as well, which gives you a lot of choices.

CarVine has a near-perfect Trustpilot rating, scoring 4.9 out of 5. This is good, but do note that they only have around 350 reviews, which may not be a large enough sample size for their score to be accurate. That said, a score like this shows signs that CarVine is a good business to use and that it can be very helpful when looking for bad credit car finance.

Most of their reviews are 5-star, and when you look at them, you can see that they’ve been praised for making the car finance process easy for their customers, even those with bad credit. People have also praised how good they are at finding deals for people who have been rejected elsewhere, meaning that they can be a great option if you’re in this situation.

When you look at the bad reviews, you can see common complaints by people claiming that using CarVine has been a waste of time as they would end up getting rejected by the lender. One interesting review came from a dealer who partnered with CarVine and was unhappy with the communication process. This can be a bit of a red flag for customers because if business partners are having trouble, then it implies a lack of organisation and trust.

This review is an isolated incident, and CarVine seems like one of the genuinely good poor credit car finance lenders.

Pros

Cons

The Car Loan Centre is a good option if you want a loan to finance a car purchase. They work for those that have good credit as well as those who have bad credit too. In fact, they specialise in those who have bad credit, making them a good option if you’ve been rejected for car finance in the past.

They consider all circumstances and have much less strict eligibility criteria to help you get a loan. Their finance plans are based on your affordability and not your credit score, meaning that if you earn enough, you’ll have improved chances of being able to get a loan.

The website doesn’t have any tools to help you figure out the cost of a loan, and it’s also unclear where you can apply for loans. There is a box where you can enter your details to get a callback, but that may not suit everyone who may want a more convenient way to apply.

If you scroll down on their page, there is a hyperlink which takes you to their application page. You can input your details to see if you’ll be eligible for car finance with the provider.

If you’re concerned about functionality and the look of a website, then The Car Loan Centre is a bit primitive and clunky and isn’t as crisp as some other options. That said, it does allow you to search for loans, and if you can look past a far-from-polished exterior, it can be a great resource to find bad credit car finance.

This is also demonstrated in its Trustpilot score. The Car Loan Centre has a rating of 4.3 out of 5 after 660 reviews, which is just about enough for this to be trusted. This rating means that it’s an excellent business with many past happy customers who benefited from the service.

When looking at the positive reviews, you’ll see that many people praised the company for going the extra mile with their customer service. There are anecdotes about people easily getting repairs and services sorted through the finance company, and in general, many people have had a good time dealing with a team member.

There are complaints against the business, with a common one being found in their 1-star reviews being that the company can neglect you once you have your car. People have found them hard to contact, and one review even agrees that the service is good at the start, but once you’re signed up the quality and care decrease.

This is something to think about if you’re considering The Car Loan Centre, which is still one of the best car loan for bad credit providers in the UK.

Pros

Cons

You can choose to use multiple types of car finance plans, whether you have bad credit or not. These different options make it easier for people to choose a finance plan that best suits them.

One of the most accessible types of car finance is a personal loan. With this, you can borrow money from a bank or dealership to use that money to pay for the car outright. This means that you own the car immediately and instead have to make loan repayments to whoever accepted your loan.

Another option is the Personal Contract Purchase (PCP), where you first put down a deposit for the car and then make monthly repayments to cover the cost of the car's depreciation in value. At the end of a PCP agreement, you don't automatically own the car and can instead give it back, exchange it for a modern car, or buy the vehicle with a balloon payment. This option has smaller monthly repayments; however usually comes with a high APR, regardless of if you are getting it with bad credit or not.

A Hire Purchase (HP) is similar to a PCP, where you need to make a deposit and monthly repayments. However, these repayments are towards you owning the car at the end of the agreement, meaning that you'll be able to sell the car once the plan is over. These usually have more expensive monthly repayments but are still a good option as you'll end up owning an asset at the end of it.

Finally, another useful car finance option is leasing. This is very similar to a PCP, as you're only renting the car and will be required to give it back at the end of your agreement. With this finance option, you're not required to pay a deposit, which makes it a more affordable option for many people. If you're not bothered about owning a car and want to experience some of the more modern car options, this is a good finance deal, although it may not be open to everyone with bad credit.

When using a provider that focuses on offering those with bad credit car finance packages and car loans, there is an increased chance that you'll be accepted. However, using a bad credit provider does not guarantee that you'll be able to get a finance plan.

This is because, in addition to checking your credit rating, many providers will also check your affordability. This basically means that bad credit car loan providers can still turn you down if you don't show evidence of you having a consistent and reliable income.

This means that people who are receiving benefits or aren't employed may struggle to get bad credit car finance. You can improve your chances of getting accepted by asking to borrow a smaller amount of money. Another option you can use is to get a guarantor loan. A guarantor secures the loan, and this individual is used to pay for the loan if you're unable to keep up with repayments. Their credit history and affordability are checked, so if they have a good credit score, you can increase your chances of getting accepted.

When you apply for car finance with a lender, your entire credit history will undergo a hard check. This is where the lender reviews your credit file to see if you've managed credit well in the past. These hard checks can affect your credit score because they leave a mark on your file.

This mark can then be seen by others who check your credit score and can indicate to them that you've applied for credit or car finance and have been unsuccessful. Applying for multiple car finance plans within a short time and getting declined for each can cause havoc for your credit score, as it implies to people reviewing your file that you're desperate to borrow money. That's why it's a good rule to only apply for a car finance provider once every three months, as this allows your credit score to recover.

If you want to find out your options when looking for bad credit car finance providers that will accept you, you can first run a soft search to see who's most likely to accept you. A soft credit search is a more general look at your credit file, and because it's less in-depth, it doesn't leave a mark. This means you can do as many soft searches as you want without affecting your credit score.

| Cookie name | Active |

|---|