© Car Adviser 2024 - All rights reserved.

> Home / Buying A Car / Bad Credit Car Finance Guide: Get Approved Today!

When you’re buying a car, there are multiple different ways that you can choose to pay for it. For many, the ideal way to fund a car is by paying for the vehicle outright in one lump sum. This option gives you immediate ownership of the car but requires you to have a lot of spare cash saved.

For many, buying a car, especially a new one, outright is unrealistic, which is why people turn to other finance options. When you pay for a car through finance, you’ll be paying for the vehicle over an extended period, making each payment a bit more affordable.

Car finance is an umbrella term, and there are various ways to finance a car. However, if you currently have bad credit or no credit history at all, it can be tough to get accepted for a car finance scheme. Thankfully, there are bespoke bad credit car finance providers that can help those in this situation.

Understanding bad credit, car finance, car loans for bad credit, and how the terms interact and relate can be difficult for people new to buying cars. Here’s an ultimate guide on poor credit car finance to help you better understand this potentially useful finance option.

If you need more help in how to buy new or used cars, you can find plenty of additional resources here on Car Adviser.

To understand bad credit car finance and its purpose, you will first need to understand what bad credit is.

Credit is defined as the ability to obtain goods and services before paying for them outright. Or, in simple terms, credit is borrowing. When you pay for something with a credit card, you borrow that balance from a bank before paying it back over time.

The thing with credit and borrowing is that it’s risky for the lenders. Sometimes when you let someone borrow something, they may not give it back or give it back late. The same thing can happen when banks let people borrow money; some might not have the means to pay back what they borrowed.

To protect themselves against this, banks and other lenders have come together to implement a thing called a credit score. A credit score uses a variety of factors to judge how worthy and reliable you are with credit. If you show signs of managing credit well and have paid back debts on time and in full in the past, you’ll have a good credit score and be allowed to borrow and use more credit products.

However, if you’ve missed repayments, are stuck in continuous debt, or haven’t started using credit products, you’re likely to have a bad credit score.

When you have bad credit, it means that you’re seen to be at greater risk of not being able to repay a loan. As a result, lenders may choose not to let you borrow money or deny you access to some of the best credit cards, loans, pre-paid cards, and, crucially for this article, car finance options.

The truth is that many car finance providers will only offer you these payment plans if you have a good credit score. This is why having bad credit can be an issue if you’re looking to buy a car.

The confusing thing about credit scores and bad credit is that there is not one universal score. In fact, there are three leading credit reference agencies that implement their unique ranking systems to determine what bad, good, and excellent credit is.

When you apply for a loan, such as car finance, the provider will check your credit report using the scores by one of these three leading credit reference agencies to see if they should lend to you. The three main credit agencies are:

One thing that people need to understand is that having bad credit doesn’t mean that you’re a bad person and are poor with money. In fact, many factors at play can result in people having less-than-ideal credit scores, and some of them are hard to avoid for specific individuals.

However, knowing what determines a bad credit score can help you understand what can be done to avoid it and improve your chances of having a good credit rating. Some of the things that cause bad credit scores include:

Suppose you or a business that your credit history is tied to has had to declare bankruptcy in the past. In that case, that will significantly affect your credit rating and likely result in you having a poor score for a reasonably long time. The issue with bankruptcy is that the effects of it can last for years and continue to appear in your credit history for a long time. This can be rather unfair as even if you have adopted good credit practices after the bankruptcy, it will still affect your score and impact what you can do in the future.

One of the main things that can significantly impact your credit rating and lead to a bad score is if you cannot keep up with any current or past credit agreements. This means things like missing a payment, being late for repayment, or paying less than what is required can all contribute to a poor credit history over time. If your score has been affected by previous mismanagement of credit, then the effects of that can linger for a while. That’s why it’s essential to try and keep up with your repayments so your score doesn’t suffer.

A County Court Judgement (CCJ) is where you’re summoned by the court to pay up any debt that you have not yet paid because you missed repayment. Having a CCJ can be a massive issue for your credit rating, as records of a CCJ will appear on your credit file for six years, which can heavily affect your borrowing power for the duration of this time period. If you repay the money you owe on time, you should avoid getting a CCJ, and even if you’re issued one, as long as you pay it within a month and get a certificate of repayment, you shouldn’t be affected by it.

When repaying a loan or credit card, some lenders will allow you to pay a minimum amount each month. Many people choose to do this as they believe that paying this amount will still be enough to pay off the loan. This is false, and the truth is that many minimum payment amounts don’t even cover the cost of interest. This means that paying the minimum can cause your debt to increase and lead to continued debt and, eventually, other financial issues, leading to a bad credit score. It’s always best to pay more than the minimum so that the debt is reduced quicker, allowing you to complete the repayment plan sooner.

If you have no credit history, that’s just as bad as having a poor credit rating. This is because a lack of history means that there’s nothing for lenders to look up, meaning that they can’t see if you’re reliable or not, which will likely result in you getting denied car finance. There are many reasons why an individual may not have a credit history. For example, they could be new to the country and thus haven’t had the opportunity to build a credit history, or they may be young and have never used a credit product for themselves yet.

When you have a credit card, you’ll likely have a limit to the amount of money that you can borrow on this card. This issue is that many people think it’s okay to borrow amounts up to the limit. However, this can harm your credit score as having a high utilisation suggests that you constantly need credit, making you look less financially independent. To stop your credit utilisation from giving you a bad credit score, try to keep it under 30%. If you have a limit of £500, try not to borrow more than £150.

Car finance is a catch-all term for a multitude of different options that allow you to borrow money to pay for a new or second-hand car. Although there are different types of car finance, they essentially all work like loans where there is a credit agreement between you and the lender.

When you have a car finance plan, you’ll be paying for your car over a period of time. You can choose how long you want the finance agreement to last, with shorter finance plans resulting in more expensive monthly payments so that you can pay it all off in time.

When you get a car finance plan, in addition to paying for the value of the car, which is the original amount you would have borrowed, you’ll also have to pay interest.

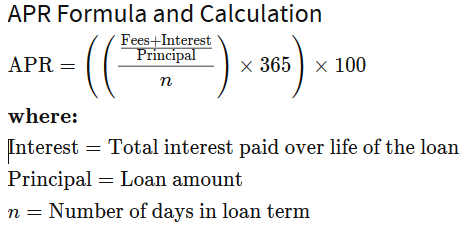

Interest is a very complicated additional cost that increases procedurally over time and is represented as a percentage of your original amount over a year.

We at Car Adviser understand that it can be tough to figure out how much more you’ll have to pay due to interest, mainly because interest compounds, which means that your interest builds interest. That’s why it’s best to use a loan calculator to help you figure out exactly how much more you’re paying due to interest. As a general rule of thumb, the lower the percentage and the shorter time you’re paying a loan back over, the less you’ll be paying back in total.

As said before, there are multiple different types of car finance options that you can choose from, with each being a bit different and having its own benefits. Some of the most common types of car finance include:

Hire Purchase is a popular form of finance where you make monthly payments for a car until you finally pay it off and end up owning the car. This type of finance plan requires a deposit for the car, which is usually 10% of the value, and fixed monthly payments.

While you’re making the payments towards eventually owning the car, the car belongs to the hire purchase company, meaning that you’re unable to make modifications to the vehicle. This means that you’re essentially hiring the car for usage until you eventually pay it all off.

This type of personal finance method is very similar to a hire purchase. You still need to pay a deposit for the car, usually around 10% and have fixed repayments. The difference is that these payments aren’t put towards you eventually owning the car and only cover the vehicle’s depreciation.

This means that once you finish the payment plan, you don’t automatically own the car and can instead give it back to the lender. This type of deal is great for those who want to make slightly cheaper monthly repayments and simply want to use and experience a car for a couple of years before moving on to a newer model.

You can keep the car if you make a balloon payment at the end of your agreement. This is where you pay the remaining value of the vehicle.

For some people, leasing is considered separate from car finance, but it’s still a valuable way to get your hands on a car and we at Car Adviser think it’s worth mentioning here. It’s pretty similar to a PCP, where instead of owning the car, you’re simply renting it over a year or two. This means that you’ll never own the car, but it allows you to swap cars frequently to get modern and up-to-date vehicles at all times.

When you lease a car, you will not be required to pay a deposit, which means that it can end up being cheaper and easier to afford for many. When under contract with a lease, you are not permitted to make changes to the car, and you’ll also likely have to pay for servicing of the car too. Many lease agreements also come with a mileage cap which can be pretty restrictive, so it may not be a good option if you plan on driving a lot or long distances.

Getting a personal loan to buy a car is perhaps one of the most popular ways to finance a car. This is probably also one of the simplest finance options, as it involves borrowing money from a bank or building society to finance a one-off car purchase.

This means that, unlike the other options, you own the car immediately when you buy it. Instead of having to pay the car owner for the vehicle over time, you rather have to pay back the bank that you borrowed from. This type of finance option is excellent if you’re looking to buy a car that you want to be your primary vehicle for a long time.

How bad credit plays into car finance is that if your credit rating is too low, you may not be able to get traditional car finance. This is because you’ll be deemed too unreliable, and the lenders will not want to risk you being unable to pay back the loan. If you’re in this situation, you’re then going to have to turn to bad credit car finance.

Bad credit car loans, also known as bad credit car loans, are essentially the same as normal car finance options, with the added detail that they’re tailored for those with a bad credit score. This means that if you have been rejected car finance from specific lenders, you have the option to turn to a provider who specialises in bad credit car finance or car loans for bad credit to help you find the right funding option for your new car. This can be the perfect option if you have bad credit and want to avoid paying for your vehicle in one lump sum of your own money. However, there are some caveats.

The thing with bad credit car finance is that although lenders will likely accept you, you will probably be charged a much higher interest rate than usual. As a result of this, your car finance plan will likely cost more throughout the plan than it would have done if you had a good or average credit rating.

There are many good reasons why poor credit car finance is a good option and is one that many people use to get a car. In fact, many drivers in the UK may not have been able to afford their car without getting into a payment plan with a poor credit car finance provider. Some of the critical benefits of bad credit car loans include:

The most significant benefit of bad credit car finance is that when you go to a lender specialising in these types of finance agreements, you’re more likely to get approved and accepted. This means that there’s a higher chance that you’ll be able to purchase a car, which can be important for those who may need a vehicle for work.

Also, guaranteeing that you’ll be able to get car finance can be helpful for your credit history. When you apply for car finance, your credit report will be searched so the lender can get an idea of how good you’ve been with credit in the past. When you apply for a loan or another form of car finance, the lender will likely complete a hard search on your credit report. This is an in-depth search that sees if you meet their criteria.

The issue with hard checks is that they leave a mark on your credit file, which indicates to others looking at your credit history that you’ve applied for credit and have been checked. Applying for car finance that you cannot get because of a poor credit score and then getting rejected will leave one of these marks. If you try many providers and continue getting rejected, you’ll end up with multiple marks on your file. These marks can start to put future lenders off, making you even less likely to get a loan or car finance, hurting your credit score even more.

So, applying for bad credit car finance and car loans for bad credit is much better for your credit score because it will limit the number of hard checks completed against your credit file. After all, you’re more likely to get accepted after one try.

Getting into a poor credit car finance plan can also be an excellent way to improve your credit score, making it easier to get things like credit cards, business loans, and better car finance options.

This is because successfully completing a bad credit car finance plan demonstrates that you can be reliable with credit and will thus work towards improving your credit score.

However, this will only happen if you’re responsible and make your repayments on time and if you pay everything in full. Even missing one monthly payment can harm your credit score and worsen your situation.

This is why a bad credit car loan can be a useful financial tool for those who are young and have just started their credit journey, as it can be a great way to boost your credit score and allow you to access more favourable loan terms.

Although a bad credit car loan can help you get your hands on a new car, even if you have a less-than-acceptable credit score, there are a few drawbacks that need to be considered to make sure that it’s the right option for you. Some things you need to be wary of when getting bad credit car finance are:

If you’re applying for a bad credit car loan or other forms of bad credit car finance, you’re likely doing so because you have a poor credit score. This means that you’re much riskier to lend to. As a result, lenders will charge you a higher percentage of APR, which means that you’ll be paying more money back due to interest.

Higher APRs can mean that those who get bad credit car finance will likely be in longer plans to have more time to pay off all that they owe. The issue with this is that the longer the plan is, the more time there is for interest to build and grow, increasing the total amount you owe.

Although this is uncommon with car loans and car finance in general, if an APR is too high and your monthly repayments are too low, you could end up in a situation known as continuous debt. This is where your interest increases the amount you owe at a higher rate than you’re paying it back, meaning that if you continue with that payment amount, you’ll never actually end up paying off the loan.

All types of car loans and car finance will come with an interest rate or with APR. However, the amount can vary greatly between providers and depending on your financial situation. You can get interest rates of 3% or less if you have a good credit score. However, if your score is bad, your interest rates can be as high as 30%. Although bad credit car finance can easily get you access to a new car, you will pay way more than what the car is actually worth.

You’re entering into a long-term commitment when you get any form of car finance, even ones that aren’t tailored to those with bad credit. Car finance plans can span years, and it’s hard to know what your financial situation will be like so far down the road. This means that a car finance plan you can afford right now may not be something you can afford in the future. This can easily lead to money issues and other types of troubles and cause strain on different aspects of your financial life.

The best way to avoid bad credit car finance from causing money problems is to budget these expenses into your spending properly. As long as you budget for this and spend within your means, it can help you prioritise and optimise your spending to avoid future issues.

That said, it’s always going to be a risk, so make sure you understand precisely how much you owe and for how long before entering into an agreement.

Although bad credit car finance can be some people’s only option to help them fund a car purchase, it is an expensive process that will have you paying over the odds. Thankfully, there are a few things that you can do to prevent you from having to pay far too much.

One of the best things you can do when taking out a PCP or HP type of bad credit car finance plan is to put down as much of a deposit as you can. Although many providers will recommend that you pay 10% of the car’s value, if you have the funds for this, nothing is stopping you from paying 20%, 30%, or even 40%.

This is a good idea because it helps reduce how much you need to borrow for your loan. This, in turn, makes your monthly repayments cheaper and also stops interest from building up as much, helping to keep how much you overpay for your car low.

That said, doing this won’t lower the APR that you’re quoted, but it will stop that typically high APR from having an effect. For example, paying 20% on a loan of £20,000 is much worse than paying 20% on a loan of £15,000. By paying extra in your deposit, you’re able to reduce how much you have to pay every month, and you may also be able to reduce the length of your contract as well.

Another thing you can do to get a bad credit car loan or car finance plan is to try and get a guarantor loan.

A guarantor loan is an excellent option for those who may not have a good credit score but may have a friend or relative who has a great score. When you get a guarantor loan, you’re getting your friend with a higher score to guarantee the loan on your behalf. If you miss a repayment, the guarantor will instead be responsible for paying for the loan.

Getting a guarantor loan reduces the risk for the lender; this way, they will have a backup plan if you miss your repayment. This can result in you getting more favourable terms and a better APR; however, the interest rates will still likely be higher than usual.

The issue with a guarantor loan is that it can cause strains in relationships, especially if you miss a repayment. This is because the guarantor’s credit history and credit score are at risk, and any issues can impact their score. At Car Adviser, we think you should only get a guarantor loan if you’re confident you’ll be able to pay it all back on time and in full; otherwise, you risk ruining some relationships.

If you have bad credit, one of the best things you can do to improve your chances of getting a good value car loan or car finance plan is to try and improve your score. Of course, this is easier said than done, but there are a few things that you can do that are relatively straightforward and can be pretty impactful.

The first thing you can do is ensure that you are signed up for the electoral register and that you're signed up to vote. This database makes it much easier to search and find your details, boosting your accountability and, thus, your credit rating.

If you have a poor credit score because you have no credit history, which can happen if you're new to the country or have recently turned 18, then one of the best ways to improve your credit score is to build your credit history and use some credit products. One of the easiest things you can do is to start using a credit card, as having a consistent stream of credit that you're paying off looks good and boosts your score. To start, you can spend small amounts on your credit card and then pay it off instantly, so you don't build any interest.

If you already have a credit history and have been using many credit products, try to keep your credit utilisation low. If you have a credit limit of £1000 on your card, it's best to use only around £300 of it or so. Keeping your credit utilisation below 30% of your allowance demonstrates that you're not desperate for credit, which implies that you're in an excellent financial situation, which can improve your score.

Other small things you can do include keeping your old bank accounts open, which will help you build a long credit history. It's also a good idea to try and have multiple bank accounts, as this demonstrates that you can manage your money well. You don't have to use them all; just having them open can help your credit score.

Avoiding hard checks can also help keep your credit score from falling and ensure that it is at a healthy level. Multiple hard credit checks can harm your credit history because they leave a mark on your file that implies that you've been looking for credit and have not been accepted. If you're looking to see if you're eligible for a car loan or another credit product, then it's best to complete a soft search, as these aren't recorded on your credit history.

Also, if you have any joint accounts or rely on someone financially who has bad credit of their own, it's possible that they could be impacting your score as well. You can improve your credit score instantly by separating yourself financially from those who have bad credit. You can issue a notice of disassociation to terminate a joint account, and after some checks, credit reference agencies should be able to remove that person from your file.

Finally, one great way to slowly boost your credit rating is to pay for utilities and other services on time. Phone contracts, broadband services, and gas and electricity can help your credit score over time because they effectively act as loans. You're given the product for a month before you pay for your usage at the end of the month. Managing these well can help slowly and incrementally improve your credit score.

Usually, when applying for bad credit car loans, you'll be doing it online via a digital form. You will likely need to provide your personal and bank details in this form.

However, if a lender cannot validate your income digitally, you will likely need to provide two months' worth of your payslips and bank statements. You will also need a copy of your driver's license or passport details to verify your identity.

Some providers will also ask for proof of address. This is to make sure that you're a UK resident. You can use various things to prove this, such as a utility bill or a bank statement addressed to this location. For these documents to be valid, they must be dated within the last three months. If you've recently taken out more credit or have a lot of gambling alerts on your credit file, then you have to share your current banking details so that they can be reviewed.

Securing a bad credit car finance plan will depend on multiple factors, including the lenders you're using to get the finance plan and the dealership or outlet from which you're buying the car.

If the place where you're buying the car is also the same place where you're getting the finance plan from, then you can expect the process to be a lot quicker than if you're using a third-party lender to get the funds to purchase a car.

If everything is in order, it's possible to get your bad credit car finance plan finalised and sorted within 24 hours. However, if more information is required, the process could take up to two weeks. Due to this massive difference between timeframes, it's a good idea to apply for car finance and give yourself plenty of time in case the process becomes drawn out and long.

There is no set credit score that you must have to be accepted for car finance. In fact, many dealerships and lenders will offer you car finance even if you have no sins of credit history. That said, these deals will likely have a huge interest rate attached and may not be the most favourable deals as a result.

If you have a credit score that is rated as good or above, which is around 660/1000 for Equifax, then you'll likely be able to qualify for car finance at a rate of 10% below. This is likely the minimum you need to get some of the best car finance deals in the UK.

| Cookie name | Active |

|---|