© Car Adviser 2024 - All rights reserved.

> Home / Best Warranty Providers For Used Cars

Find the best warranty providers for your used car in the UK.

A warranty can be a great way to protect you financially if your car has faults and needs to be repaired. The only issue is that they can be pretty expensive, and with there being multiple places to get them, it can be hard to know where is best.

Here’s a look at some of the best warranty providers for used cars, detailing their benefits and review scores to figure out which provider is the best for you. Car Adviser has plenty of advice and guides to help you if you need more information about buying a used car.

A warranty is very similar to an insurance policy. With a warranty, you’ll be able to have the costs of labour and repairs covered for you by your provider if you need to get certain parts of your car fixed. A warranty will usually only cover issues considered mechanical or electrical failures, meaning that instead of covering the costs of damages from a collision, they financially protect you if your car has failed on its own.

There are multiple different types of warranties that you can get; however, they all pretty much provide the same service. The first type of warranty is a manufacturer warranty that you’ll likely get when you buy a new car. This warranty will usually be free and last a reasonably long time, which is a significant reason why people opt for new vehicles. Because these warranties can last around three years and even longer with some manufacturers, if you’re buying a nearly-new car, it’s likely it will still be under this warranty.

If you’re buying a used car, you can also get a warranty from the dealership. This will likely be an ‘approved used car warranty and will last around 12 months. When you get this type of warranty, you’ll likely only be able to get the car serviced and repaired by the dealership or franchise you bought it from for the warranty to remain valid.

You can also buy a used car warranty independently after you’ve bought a car. These are often called aftermarket warranties and are the types of warranties that will be compared in this Car Adviser article. These warranties are excellent because you can get them if your current warranty is expiring, and they’re usually better deals than the other types of warranties.

The length of a warranty will vary depending on the provider you choose and your terms, although a typical warranty will last for three years or 60,000 miles, whichever comes first.

Getting financial protection for you and your car is always good, especially on a used car. The costs of some repairs can be a lot of money and become a significant financial burden if you have to finance them yourself. A warranty protects you from having to pay a large amount of money and gives you the means to repair your car quickly.

As a used car is much more likely to need repairs and servicing than a new one, you should consider getting a warranty. Even if your used car comes with a warranty from the provider, it may be worthwhile getting a different one to provide cover for when the original one expires.

Of course, there’s always a risk that nothing will happen to your car under your ownership, meaning that your warranty can become a waste of money. Plus, there are also a lot of issues that aren’t covered by a warranty, meaning that you could end up in a situation where you’re paying for a warranty and then also need to pay for the repairs anyway.

That said, the potential money you can save with a warranty makes it super worth it and is something you should get, especially when buying a used car.

The specific issues and faults covered in a warranty will differ depending on the provider and the level of cover you get. That said, there are a few mechanical problems that you can expect to be fixed in even the most basic level of cover.

For most packages, the cost of repairs to your engine will be covered at a bare minimum. This is good because engine issues are usually one of the most expensive things to repair, so having that covered for you with worthwhile and protects you financially.

On more advanced packages, you can also build a comprehensive cover that will pay for the repairs of damages and issues to your:

Of course, the specifics of what is covered will vary between policies, so check your contract to see what’s included.

A few common issues do not fall under most warranties, so it’s essential to be aware of these to know your options. If you have issues with your batteries, bulbs, wheels, and tyres, these are repairs you’ll likely have to pay yourself.

Damages to your car due to wear and tear, such as damage to heavily used parts like the brake discs and pads, will not be covered either. Plus, you’ll also be unable to use your warranty to pay for cosmetic repairs, such as a new paint job or fixing the car’s interior.

Finally, accidental damage and vandalism are usually not included in a warranty, and for those that do have it, it’ll likely be for an additional cost.

These are the most popular used car warranty providers in the UK for 2024:

MotorEasy is an auto business that offers many different car services, such as GAP insurance and warranty cover.

MotorEasy is one of the best places to get warranty coverage because you can get a policy that includes wear and tear damage. Usually, this is omitted, meaning MotorEasy can be a great place to get a comprehensive cover. In addition, MotorEasy allows you to get a bundle of their services that includes an MOT and service in addition to a warranty, all for a discounted price.

Another great thing with MotorEasy is that the business pays the garage directly. This means you don’t have to part with any cash and wait to be reimbursed, which adds extra peace of mind.

With MotorEasy, you can get a warranty for used cars and new vehicles and even extend an original manufacturer agreement, meanin that there are plenty of options for multiple people. Their cover helps protect you from:

If you’re looking for complete coverage and services for your car, then MotorEasy is one of the best places on the internet.

On Trustpilot, MotorEasy has an excellent score of 4.7 stars out of 5. This makes it one of the most liked warranty providers in the industry. Trustpilot is one of the most used and respected review websites online, so this score accurately reflects how the business performs.

However, it’s important to note that MotorEasy is an auto business that provides multiple car services, with warranties being just one of the things they provide. This means that their reviews also include feedback on their other products, meaning that this 4.7 score may not be entirely accurate for just its warranties.

That said, because the business has over 8,000 reviews, it has a large enough sample size for its review score to be respected. It also means that its score is more unlikely to be influenced by fake reviews, meaning that users can trust this score.

Out of all the people that left reviews, 83% gave MotorEasy a 5-star review, with an additional 11% giving it a positive 4-star review. This percentage of praise and satisfaction demonstrates that MotorEasy will likely be a warranty provider that people like and get a good service from.

Only 4% gave MotorEasy a 1-star review, meaning that just 300 people out of the thousands that left reviews were unhappy with the service. That’s a good ratio and is a significant reason why MotorEasy comes highly recommended.

When looking at the positive reviews for MotorEasy, you’ll find a lot of common praises that indicate what MotorEasy does exceptionally well. This is useful to look at as it can let potential buyers better anticipate what the service will be like.

One praise that you’ll find is that the claim process for a warranty is typically easy to do and is pain-free, with the team responding quickly and finding a solution to claims rapidly. People also liked how the business will organise repairs with a local garage so that it’s easier for the customer to get their car repaired.

Another bit of praise was for how the business keeps you well informed and up-to-date about the progress of your repairs. This can be a welcome bonus for situations where the repairs may take a long time, as it gives you peace of mind that your vehicle is being worked on and looked after.

Although MotorEasy has a limited number of negative reviews, there are still a few common complaints you can find in these. It’s worth looking at what past customers thought was wrong about the service because it allows potential customers to weigh the positives and negatives.

A common complaint is that MotorEasy can be very thorough and strict when checking to see if your vehicle is eligible for warranty coverage.

Multiple people have reported that the company not only sends your car to be reviewed by numerous mechanics but also sends their private experts to confirm that work needs to be done.

This can be time-consuming, and sometimes, people have had their warranty claim rejected. It’s worth being cautious that many warranty providers, MotorEasy included, will do what they can not to pay out to save them money, so the faults will need to be precise.

Pros

Cons

Click4Warranty is a bespoke online warranty provider that aims to make warranty cover simple to understand and easy to use and buy. Click4Warranty achieve this by offering streamlined services that aren’t too complicated or filled with bonuses or additional cover. Instead, you get a comprehensive cover right from the box.

Compared to other warranty providers, Click4Warranty only asks a little from you in order to begin your warranty coverage. All you need is a car under ten years old that has stayed within 100,000 miles when you first take out coverage. That’s it. You don’t need to complete a pre-inspection to get cover, and you aren’t even asked for an up-to-date service history, which takes away a lot of the hassle when getting warranty cover.

The only potential issue is that certain cars are excluded from their cover. The website has a complete list of these vehicles, but some of the most common include:

In addition to these general exemptions, some popular and luxury car brands are excluded, mainly because of the overall value of these cars. Some of the manufacturers that won’t be covered include:

Despite these expectations, if your car is eligible, you’ll get good quality cover with Click4Warranty. In terms of how much you’re covered for, the brand offers coverage up to the total value of your car – determined by Glass. With that coverage, you’ll get protection for mechanical breakdowns, service or MOT imminent breakdowns, and more.

This comprehensive cover should give you increased peace of mind when using Click4Warranty. In addition, you’ll get cover from day one with no waiting period, and you won’t need any service history for your cover to start.

In terms of the different warranty packages that Click4Warranty provides, you’ll be able to choose from two options. These are Advance Car Warranty or Advanced Plus Car Warranty. There are significant differences between the two, although they provide a great deal of cover.

When you get Advanced Car Warranty, you’ll get cover for all the significant parts of your car that keeps it moving. This means that issues with your fuel injection system, cooling system, clutch, brakes, gearbox, steering, wheels, tyres, and more are covered.

In addition, this type of cover also gives you cash towards replacement cars if you ever need one. You can also expect contributions to the roadside recovery of up to £100, and you get cover when abroad for 90 days in Europe or Ireland.

The Advanced Plus Car Warranty is an enhanced version of their basic plan and is far more comprehensive while only having specific exceptions.

This plan will cover labour costs and most issues, such as wear and tear cover for up to 6 years, cover for oil seal issues, and air conditioning re-gassing.

The only exceptions with the Advanced Plus options are that you won’t get covered for body paint or windows, electrical wiring issues, and items that are usually replaced with a service.

Claiming with Click4Warranty is easy; all you need to do is call them directly to start the process. Their technicians will be able to guide you from them. To be eligible for a claim, you must ensure that you keep up with your annual servicing. If you do that, you should find that getting cover is easy, making Click4Warranty one of the best options you can go for.

Click4warranty has a very good review score in Trustpilot, the leading review website online. With a score of 4.5 stars out of 5, it’s ranked as an excellent business and indicates that many past customers have had a good experience getting warranty cover with this brand.

When looking at the breakdown or reviews the business has received, you’ll see that 88% of people have given the company a positive review – either 5 or 4 stars – indicating that most people have been happy.

Only 8% of people have given the business a 1-star review, meaning that issues and complaints are rare.

In addition to these good reviews, Click4Warranty also won an award for being the best warranty provider in 2020, meaning the business has some past pedigree to fall on.

Click4Warranty has received a lot of praise on review websites. One of the most common they receive is for their customer service team, with many people saying that communication was excellent and that the operators were accommodating when calling to make a claim.

People are also happy with the speed with that they’ve been able to both purchase and claim their warranty cover, indicating that this is an efficient business.

Although there are not many negative reviews, when you look at only the 1-star reviews, you’ll find that common issues keep coming up. It’s worthwhile knowing about these so that you can anticipate these happening to you.

One of the most prominent issues is that many people complain about the business not paying for certain cars listed as exempt. Although it’s clear on the website that these cars aren’t covered, it seems that in a few instances, the warranty was still sold.

This means that it’s essential to check if your car is covered before purchasing this cover, as it seems the business will not warn you during the transaction or prevent you from getting cover for a car that is excluded.

Pros

Cons

In addition to offering GAP insurance, you can get a pretty comprehensive warranty policy from ALA. Many people turn to ALA Insurance for a warranty because they offer a RAC warranty, which is a well-trusted brand.

When getting a RAC warranty supplied by ALA, you get a day one cover that doesn’t require a pre-inspection. This means you can be confident that you’ll have cover, no matter how soon an issue appears within your warranty period. ALA is the only place you can get a RAC warranty online, meaning you’re getting a quality, well-trusted service.

The warranties offered by ALA on behalf of the RAC have been given many awards and endorsements and have been recommended by various publications such as What Car?, Autocar and JCB. As it’s part of RAC, a famous breakdown cover provider, this is one of the few warranties to include the cost of roadside recovery and onward travel.

There’s also no excess when you make a claim with ALA insurance, which means that you don’t have to pay anything before you’re eligible to make a claim. This means that no matter the issue, as long as it’s part of your policy, you’ll be able to get cover.

This warranty is offered as a standard, Premium, and Premium Plus option. With them, you can expect to get cover for issues with your engine, timing belts, exhaust, turbo, cooling components, fuel system, and drive system. You can also get wear and tear cover, but only with their Premium Plus cover.

Because it provides RAC cover, getting a warranty from ALA Insurance can be one of the best options for a used car. It’s also one of the only insured warranty providers on this list, which greatly benefits the consumer. Being an insured warranty provider means that ALA has mandatory regulations they need to comply with, and it also means that you’re able to dispute a decision if it’s not in your favour. However, perhaps the biggest advantage of ALA being insured is that you’ll still get cover or compensation if the company were to go bust.

With a near-perfect review score, ALA Insurance is one of the highest-rated warranty providers on the web. This score indicates that many past customers have been pleased with the service they’ve received and that you’ll likely have a good experience too.

It’s worth noting that some of these reviews may be for ALA’s other products, such as its GAP insurance, meaning that this score may not be a completely accurate score for its warranty policy. That said, it still ranks well, and with over 13,000 reviews, it’s clear that this score can be relied on, as the large sample size reduces the risk of fake reviews influencing the score.

The warranty provider has a lot of 5-star reviews, with 92% of all reviewers giving it top marks. In contrast, less than 1% of their reviews gave a single star, meaning that vastly more people had a good experience with the brand.

Because there are a lot of positive reviews for ALA Insurance, there are many different forms of feedback, making it difficult to pinpoint a single thing that ALA insurance does better than other things. Their overall service and quality are often praised a lot, with many people valuing the free recovery and roadside assistance services.

People also stated that their warranty was good value for money, which is nice for those comparing different providers.

Although there are barely any negative reviews, out of the few that are on Trustpilot, it’s clear that there is a consistent issue that people haven’t been a fan of in the past. Many past reviews complain that they’ve been refused cover due to not keeping up with the service requirements. Although all providers will have this, ALA seems pretty strict with it, as even if you miss it by a day, the warranty will be void.

In addition, there have also been complaints about how the company rejects many claims that may appear legitimate, with them looking for a few loopholes to avoid paying. This is going to be a common complaint for every provider.

However, it can be helpful to see which one gets more than the others. As they have a low volume of complaints, this particular issue seems to be very rare.

Pros

Cons

The AA is one of the leading breakdown cover providers in the UK, so it makes sense that they also provide a warranty for used cars. The AA covers almost all mechanical and electrical faults, and there’s no limit to the number of times you can claim.

Plus, all their warranty packages give customers access to 12 months of free breakdown cover. If you’re already a member and get a warranty, you’ll be able to upgrade to a better plan for a cut price.

The AA stands out as they also give warranties to electric and hybrid vehicles, which is not something that all providers do. All these features mean that the AA is a good provider if you want peace of mind when driving a previously owned vehicle.

They also offer extra cover for wear and tear, which you can add to your policy. This makes it a great option, as many other top brands exclude this type of cover. That said, it’s only valid if your car has done under 85,000 miles, which isn’t a lot.

Although the AA is a respected breakdown provider and has a good reputation on Trustpilot with an excellent score of over 4-stars, its warranty service has a much more average rating of 3/5. This score is one of the more average ones out of all the providers viewed on Car Adviser; however, you shouldn’t be put off too much as the AA is still an outstanding provider.

The AA as a company has a lot of reviews for it on Trustpilot, meaning that its review score can be trusted and deemed accurate due to the high sample size. However, its warranty-focused page only has 300 or so reviews, meaning that the average score can easily be manipulated with fake reviews or review bombing, so you should take the 3/5 rating with a pinch of salt.

Out of all the reviews, only 35% gave the AA a 5-star review for its warranties. This is much less than the previous two providers, and even when you include the 4-star reviews, only 46% of their reviews are overwhelmingly positive. To compare, 44% of all reviews for the AA warranty is a 1-star. This means there’s a very even split between happy customers and those who are disappointed. This means that there could be a chance that you have a bad experience with the AA.

When looking at the 5-star reviews that the AA has gotten, it’s clear that there are a few common praises that the company receives. This means that these aspects are the strongest of the company and are stuff you’ll likely have a good experience with.

One of the main things you’ll see is that the customer service you’re likely to experience will be good quality, with the staff being helpful and informative and able to guide you through the process and answer your questions.

Many people have also said that it hasn’t been too difficult to use the warranty and have your car covered, and some people have been able to use it multiple times within the warranty length.

There are plenty of negative reviews against the AA’s warranty service, and among them, some common issues seem to emerge, which paints of picture of what to expect if you choose a warranty from them.

The main issue for many is that when you claim with the AA, you first have to pay for the repairs and then the warranty provider will refund you. This can be a bit difficult if you don’t have the finances to cover the cost of the repair, especially if it’s a significant expense, and it could be a bad experience if you’re left waiting a long time for the refund.

Many other people also complain about how their claims were rejected as issues were deemed wear and tear, which they don’t cover. This happens with every provider; however, the AA has many more reviews like this, suggesting that it’s more common with them.

Pros

Cons

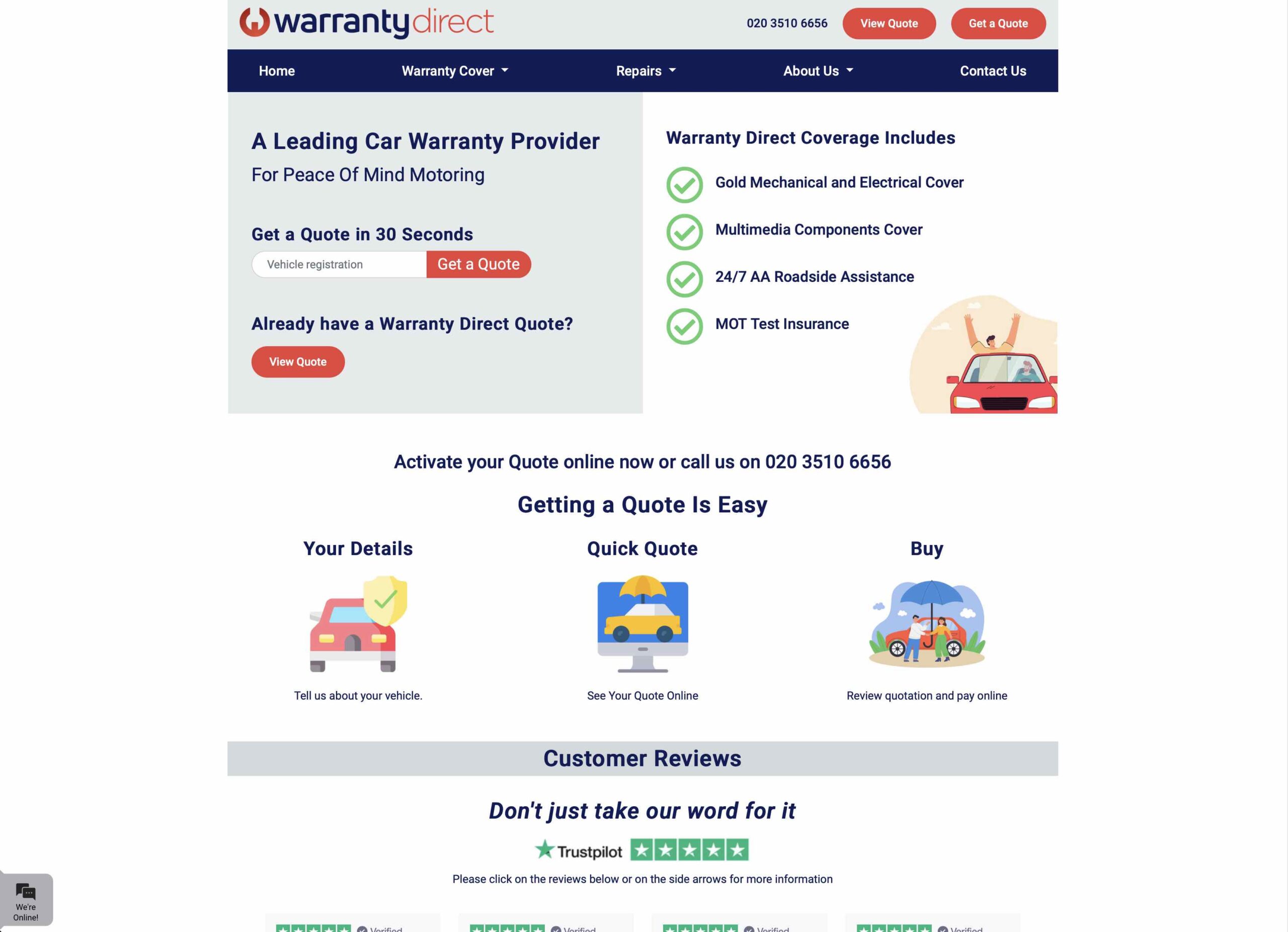

Warranty Direct specialise in providing warranties, which is why they can get you a quote within 30 seconds, making it a pretty speedy process. With Warranty Direct, you get a Gold-standard mechanical and electrical cover and cover for all your multimedia within the car.

As it partners with the AA, you can also get 24/7 roadside assistance, which can be a massive advantage over the AA’s warranty if you can find a deal for cheaper. In addition, you can get insurance for your MOT test, making this a complete warranty package.

Their gold cover means that most issues and parts will have protection, meaning that you’ll likely be able to make a claim no matter what goes wrong.

It’s not quite the same if you have an electric vehicle, though, as things like the battery are not covered, which can be a bit of a risk as that’s one of the main components that break.

That said, Warranty Direct is said to be easy to claim from, and they’re considered one of the best places if you’re looking for focused and specialised warranty services.

Warranty Direct has a good score on Trustpilot, which makes it appear as a pretty good business to get a warranty from. They have a good number of reviews, which is just shy of 1,000, meaning that it has a suitable sample size to suggest that the score accurately reflects their quality.

When you dig deeper into how the past reviewers voted, you’ll find that 72% of people gave the company 5-stars, and 11% gave 4-stars. This means that more than 4/5 had a good experience with Warranty Direct, which is an outstanding ratio.

11% of people did give the company a single star, which is more than a few other businesses reviewed on Car Adviser. With it being the joint-second most common score, it does raise slight red flags that there could be issues lurking.

Out of the 5-star reviews, many people praised the prices offered by warranty direct, stating that they’re one of the cheapest in the market. As well as that, people were pleasantly surprised to see that the business covers the costs for not just the repair but also diagnosis and parts. This makes Warranty Direct excellent value for money.

People also praised how helpful the staff was when dealing with issues and requests, which shows that you can expect a good experience using Warranty Direct.

When reviewing the 1-star ratings, you’ll find the common issue that people are unhappy that their claims have been rejected. These are very few and far between, suggesting that it’s not much of a problem as it is for other brands.

People have also complained about the quality of the website, stating that it crashes when payment details are entered. This is something to be wary of when using Warranty Direct.

That said, most of these negative reviews are over a year old, meaning that there have not been many complaints from people over the last year, implying that Warranty Direct is reliable and good.

Pros

Cons

WarrantyWise has been providing warranties for 22 years in the UK, meaning they’re an experienced brand that knows what they’re doing.

When you get a policy with WarrantyWise, you’ll get access to unlimited repairs, cover for both parts and labour costs, and the ability to get car hire and onward travel if your vehicle is out of action for a while.

What’s incredible about WarrantyWise is that you can get warranties for various vehicles, such as vans, meaning that it’s a good option for those looking to get warranties for business vehicles.

With this provider, you get cover for wear and tear from day one, meaning that you can rest assured that no matter what goes wrong, you’ll likely get the help you need from WarrantyWise.

There’s not a lot to dislike about WarrantyWise, and it could be one of your best options.

WarrantyWise has a very respectable score of 4.4/5, making them one of the higher-rated warranty providers reviewed on Car Adviser. The brand has been reviewed by 4,700 people, meaning that it has a large enough sample size to indicate that the score is somewhat accurate and reflects well the genuine quality of the provider.

With an excellent rating, you can expect good service when using Warrantywise. 71% of users gave the website a 5-star review, and another 10% gave it a positive 4-star. That said, 15% have given it the lowest rating of 1-star, the second highest percentage out of these reviewed.

This means that although WarrantyWise is typically good, there is potential for problems.

Out of the many 5-star reviews, one of the common praises that you’ll find is that the company’s customer service has been considered excellent. Many past users of the website found the staff helpful and informative.

People have also expressed happiness about the level of cover you get with the price, making it an excellent option for those who want to get the most out of their money.

Out of the negative reviews, you’ll see that the majority of complaints are about the company not paying up when you make a claim. This is something that comes up often for all these providers. However, this company’s sheer volume of these types of reviews is a concern.

It suggests that it might be tough to get a warranty payout, with many issues being overlooked as wear and tear.

Pros

Cons

These are the best used car warranty providers in the UK:

When buying a used car, you'll want to ensure that your warranty lasts at least 12 months, with 24 months being a good time to have a warranty.

When getting a used car from a website such as Cazoo, they'll either include a 90-day warranty or sell you a car that's still under the original manufacturer's warranty.

However, to ensure that you can safeguard your vehicle, getting your own warranty cover from an independent provider is a good idea. When you do this, you'll be able to get your car repaired and serviced for free if anything goes wrong, which protects your purchase for the long term.

It's not a legal requirement for people selling a used car to offer a warranty. When buying used cars on the cheaper side of the market, you'll find that most are sold without a warranty.

That said, a few used car sellers, especially some of the best websites online, will offer a warranty on their cars. They do this to help their business stand out within the market and look like one of the better value options. These warranties often don't last that long, so you'll likely have to buy your warranty agreement from a private provider anyway.

Because warranties aren't a legal requirement, you can try to reduce the cost of a used car by waiving a warranty. This can be a good haggling technique to save you a few pounds, especially if you're getting a warranty from someone else.

The amount that a car warranty costs you will depend on multiple factors, meaning that the amount you have to pay will fluctuate drastically from someone else, even if you're using the same provider.

The first significant factor is the car you're getting the warranty for. If it's an expensive vehicle, the repair cost may also be pretty expensive, meaning that the warranty will likely cost more. That said, if the car is old, your warranty may also be a bit higher because there is an increased risk that the car will break down.

Plus, the mileage on the vehicle is also an important factor in determining the warranty cost. If there are a lot of miles clocked up on the car, it indicates that it's been through a bit of natural wear and tear and thus may be at greater risk of breaking down. Plus, your average mileage can affect the warranty price as well. This is because if you drive your car a lot, you're more likely to use your warranty.

Finally, another factor that determines how much a warranty cost is the level of coverage you're going to get. For example, a basic warranty that only covers issues with an engine will cost less than a more extended warranty that also includes repairs to brakes, gears, and electrical components.

To keep the warranty costs down, compare the different providers to see who offers the best deals for you. You can also reduce costs by opting for the most basic coverage. Just be aware that having the basic cover may mean you'll have to dip into your pockets to fix an issue if it's not covered in your package. That's why it may be a worthwhile thing to get a more premium warranty.

When you get a car warranty, it can either be insured or uninsured. Understanding the difference is worthwhile when comparing the different warranties you can buy.

An insured warranty is regulated by the Financial Conduct Authority (FCA). These providers must follow the same guidelines and practices as other financial businesses, protecting the customer. These warranties are also members of the FSCS (Financial Services Compensation Scheme). As a member of the FSCS, it also means that these insured policies are protected and honoured if the company was to go bust. This means that you'll still be able to use your warranty and won't lose out on your money should this situation happen.

Uninsured warranties do not have this financial protection, meaning you could lose out on your protection if the company were to go bust. However, non-insured providers are likely part of the Motor Ombudsman Body (MOB). This means that they will operate under a set code of practices to ensure that good standard are met when you use them.

Just like when you claim on insurance, there is a possibility that your warranty provider can reject your claim and not provide you with any funds to pay for your car's repairs.

You may be unable to make a successful claim for multiple reasons, and all of these should be on your agreement when you first buy the warranty. Some everyday situations where your claim is likely to be rejected include:

| Cookie name | Active |

|---|