© Car Adviser 2024 - All rights reserved.

> Home / Breakdown Cover / The AA

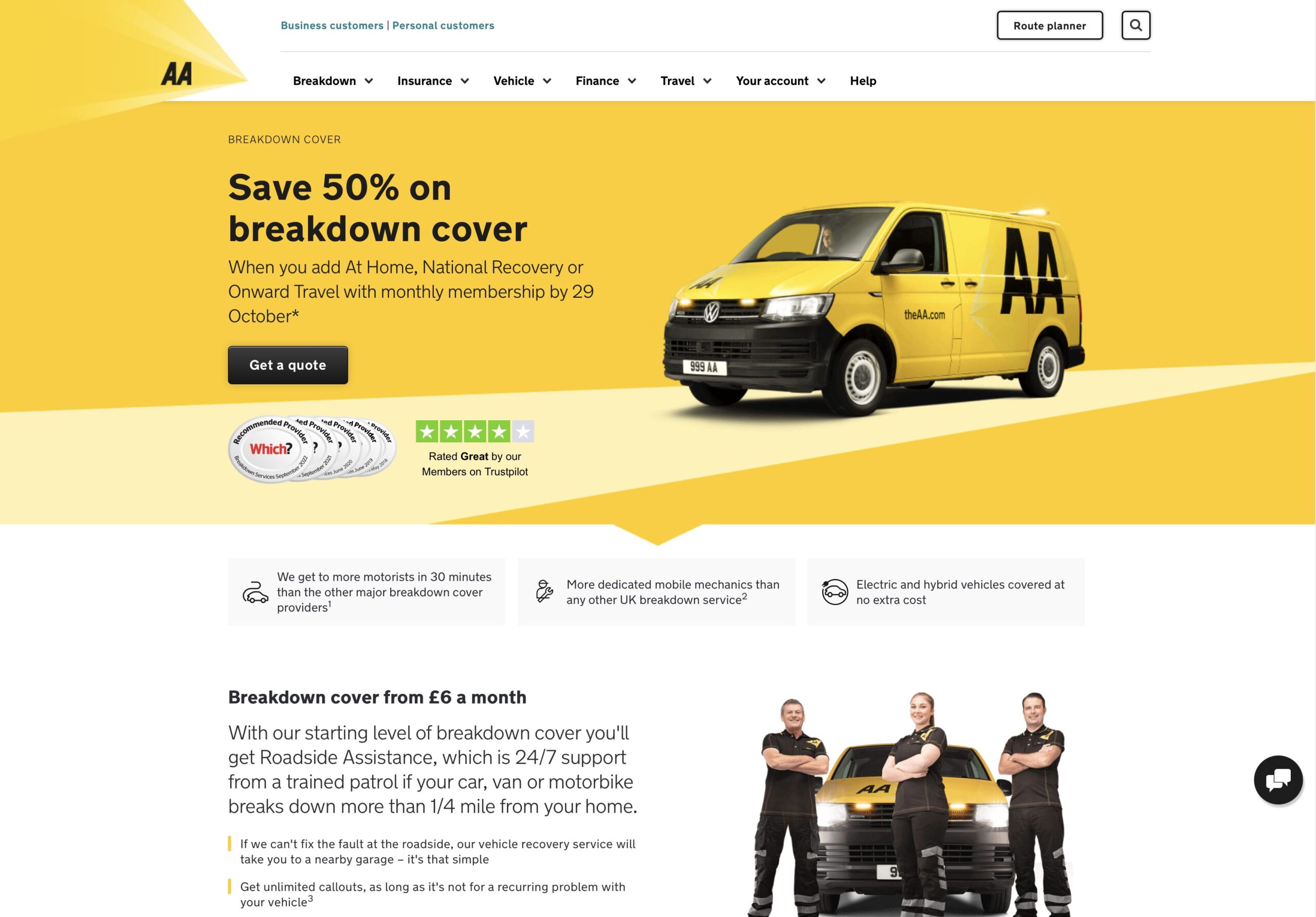

The AA is one of the UK’s most recognised breakdown cover providers.

The AA has been helping drivers and other road users repair their vehicles since 1905. In that time, it’s become an institution within the country. With many other breakdown cover companies in the UK offering a similar service, does the AA still reign supreme?

This guide reviews the services offered by the AA to see how it holds up and if it is still the best UK breakdown cover provider of choice.

When you get a membership with the AA, you’ll receive many features, depending on your membership level.

For the basic membership, you’ll get 24/7 cover for breakdowns that happen over a ¼ mile from your home. You’ll also be able to get unlimited call-outs, and they have a dedicated accident service called accident assist.

In addition to this standard level of service, you’ll also be able to add extra features, choosing the ones that best suit your needs and circumstances. You can add things like European breakdown cover and key or tyre replacement.

There are a few exceptions when it comes to AA breakdown cover. It’s good to be aware of the situations in which your cover isn’t eligible before becoming an AA member.

Despite having accident assistance, you won’t be covered for any roadside assistance if your breakdown involves the emergency services, such as the police or ambulance. You also won’t be covered for any routine maintenance repairs.

Finally, if you need regular call-outs for the same fault, the AA will not cover this. So, if you constantly have issues with your battery that requires roadside assistance, it’s best to get the issue fully repaired to stop you from needing assistance.

The cost of The AA cover will vary depending on the breakdown cover you choose.

Like other breakdown services, the cover you get is broken into tiers known as levels. The basic level is the cheapest but will lack additional benefits and protection that could be useful. As you increase through the levels, the greater the cost.

It’s also possible to add extra features called add-ons to your cover. These can include things like European breakdown cover, key replacement and more. Each add-on will be individually priced and added to your policies monthly or annual cost.

The AA’s basic level cover, which includes roadside assistance, can cost £79 a year for personal cover. Its highest level cover, which includes roadside assistance, at-home servicing, national recovery, and onward travel, can cost £199.

This price range makes the AA one of the more expensive breakdown services. When comparing its top-level service, it’s over £20 more than RAC per year.

However, the AA could be the best option if you’re looking for basic cover. Many other breakdown providers include at-home cover in their standard packages, increasing the costs. Other providers can charge over £100 a year for their basic level cover, so if you’re happy to have a stripped-back version of breakdown cover that includes just the essentials, then the AA may be the best choice for you.

The AA can be considered one of, if not the fastest, breakdown recovery service. This means that when you use the AA, you usually won’t be waiting for long to have your vehicle seen to.

A reported 81.96% of call-outs were completed within the hour, and this statistic dwarfs some of the other most well-known breakdown services.

In fact, the average wait time for roadside assistance or roadside recovery from the AA is around 4o minutes. This allows members to have their car repaired quickly to continue the rest of their journey.

Waiting on the side of the road near a broken-down car is dangerous, especially if it’s on the hard shoulder of a motorway. Reducing the time you have to wait on the roadside decreases the risk of accidents. This makes The AA one of the safest breakdown cover providers, as on average, you won’t be waiting that long for assistance.

When waiting for roadside assistance, it’s advised to leave your vehicle and stand a few meters away from it. This can help protect you in case another road user accidentally crashes into the back of your broken-down car. To protect yourself further, it’s also a good idea to carry a high-vis vest so that you can easily be spotted by cars and other vehicles.

Much like most breakdown cover services, you’ll need to be a member to get the full scope of benefits and services from The AA. However, if you’re not currently an AA member, you can still call them and get roadside assistance whenever you need it.

When using the AA without being a member, you will be charged for the services you use, and these costs will likely be more than you pay through your membership subscription.

The AA isn’t the only breakdown company to offer assistance to non-members, as RAC also provides this. However, the benefit of using the AA is that they’re typically one of the fastest providers in getting someone to come out and help you.

Of course, if you use the AA without being a member, there will be some features and support that you won’t be able to get. For example, you won’t get a hire car to replace your vehicle while it’s in the garage, and you may only be able to use the AA for roadside assistance only. This means you won’t be able to use the AA for at-home services without being a member.

There’s no point getting a mechanic to your broken-down car quickly if they cannot fix it. With the AA, they claim that 8/10 cars were able to be fixed at the roadside. This is more than any other breakdown service in the UK.

Having your car repaired on the roadside prevents the need to have your car towed away to a garage, which can be time-consuming and cumbersome. However, if you need to have your car towed away to be repaired at a garage, the AA will be able to do this as standard.

They’ll be able to transport your vehicle to the nearest garage within a 20-mile radius. This distance is larger than many other breakdown services, allowing you to get to the best garage available.

If the AA cannot fix your car on-site, you may be eligible to claim a refund or price reduction for the call-out.

On the whole, the AA is one of the best options regarding breakdown cover in the UK. It has a lot of benefits that make the service stand out when compared to its competitors. However, the AA has a few flaws that let it down and prevent it from being a perfect breakdown cover provider.

Pros

Cons

The AA is one of the oldest and most beloved breakdown cover providers in the UK. The company uses its experience to provide a comprehensive and robust breakdown service that makes it one of the best in the UK.

Mixing and matching the services you want allows you to build a bespoke policy that best suits you.

The AA is the fastest regarding roadside assistance and has the highest success rate of getting your vehicle fixed without having to go to the garage.

However, this quality means it’s one of the most expensive breakdown cover providers available. If its price falls within your budget, then there are not many better options, although if it’s too expensive, there are suitable alternatives that will provide a decent service for a better price.

All in all, the AA is a great breakdown cover provider and one that you should consider when looking for your own policy.

| Cookie name | Active |

|---|